Summer is supposed to be the season when the only thing to pursue seriously is leisure. The culture sections of newspapers (or their online equivalents) are loaded with lists of books you should read at the beach. Of course, that’s essentially an unreachable ideal, like your author keeping his truck washed. (A little Vashon humor there.)

Instead, this summer we are in the final months of a presidential election cycle—something that typically elicits excitement, anxiety or perhaps simple curiosity. The past month has seen historic developments, with an assassination attempt on one of the candidates and the withdrawal of another, turning what was (according to voter polling) a boring rematch into a race that will be discussed for years.

Adding to the drama, starting last Friday, we have been treated to financial market volatility widely attributed in the financial press to…wait for it…“the unwinding of the yen carry trade.” If that wasn’t on your bingo card, you are in good company.

This drama coincides with our usual calendar to write about the financial markets and the economy for the quarter ended in June—and it’s been good news. US large cap stocks were up 4% for the quarter and 15% for the year and the economy expanded at a 2.8% annual rate while inflation continued to moderate. We could talk more about that, but we expect recent events and the election are more on readers’ minds, so we will instead share our perspectives on the role of presidential elections in financial markets and the consequences of market action like we have just seen.

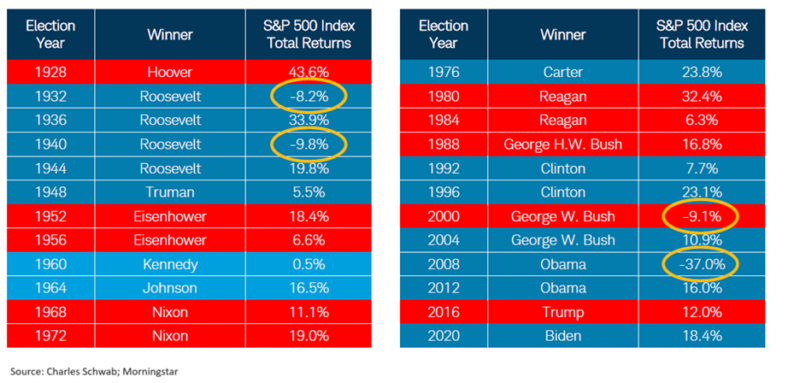

First, to address the election cycle and financial markets, it is worth examining presidential election years and results for the US stock market. As you can see from the chart below, results are overwhelmingly positive for financial markets in presidential election years. The exceptions have everything to do with major economic dislocations already under way: the Great Depression in 1932 and 1940, the Dotcom Bust in 2000 and the housing collapse and Global Financial Crisis in 2008.

In addition, the stock market has generally advanced under both Democratic and Republican presidents, and, appropriately given our Constitution setting out divided powers, markets have generally done best with some division of leadership between the Presidency and Congress.

No matter your political preference, elections often bring big emotions—big anticipations and hopes or, on the flip side, big disappointments and fears. These emotions arise from how much we care about our country, our communities and our families, so we embrace that source. Yet the greater we feel the intensity, the more we may lose sight of the fundamental principles of investing.

We acknowledge that this data and counsel may seem unsatisfying and even frustratingly mundane in the context of elections that can be so consequential. As your financial planning team, our job is to help reduce the noise of the political media and moderate the emotional aspect, such as by recalling the historical record above. Additionally, as with most aspects of investing, consistency is usually best. Big movements in response to one single event, or an anticipated event, often prove incorrect or ill-timed. Therefore, as we review and manage your investment portfolio, we take great care to not let emotions around parties and public policy dictate our decisions, but rather use known risk factors around monetary, trade and tax policy as the drivers for investment decisions.

Second, recent financial market volatility, largely ascribed to “unwinding the yen carry trade,” is a reminder that we are living through the epilogue to a multi-decade experiment with very low interest rates, a key topic of our newsletters since the Global Financial Crisis. At that time, the US Federal Reserve adopted the Bank of Japan’s (BoJ’s) zero interest rate policy (ZIRP).

This week’s volatility arose as the BoJ started exiting ZIRP, causing investors who had borrowed yen at low interest to invest in Japanese stocks or high return assets abroad to sell those assets (and repurchase yen at higher prices for those who invested abroad). JP Morgan Chase, a large custodian bank, estimates that about half of the related investment positions have been unwound. Thus, we could yet see more turbulence as that trade is further unwound. If a major financial institution is threatened by losses from trades being closed, we would expect turbulence to be more pronounced, but we’re not aware of any such fragility. In time, we expect this episode to take its place in financial history with other disturbances, such as the Russian debt default and resulting collapse of the hedge fund Long-Term Capital Management (victims of a past Fed interest rate hiking cycle) that have faded in importance (and memory) as shown in the chart below. (Note: The upward movement in the right of the chart is enhanced, like any chart of long-term compounding data growth, by not being presented in logarithmic form (a scientific format unfamiliar to most readers).) We’re guessing that many investors today are not familiar with the Russian debt default of 1998, which is precisely our point.

For those interested in more background on the yen carry trade, you might recall that the US Federal Reserve kept ZIRP in place for about 10 years following the housing collapse and brought it back to fight the effects of the economic shutdown during the early stage of the Covid pandemic. When inflation followed the pandemic, the Fed exited ZIRP in Spring 2022 by hiking its target rate, eventually to 5.0-5.5%. However, the BoJ remained a practitioner of ZIRP until earlier this summer, and in fact was the modern instigator of using aggressive monetary policy to revive inflation following their asset bubble collapse in the early 1990s. Thus, Japanese investors had become aggressive overseas investors in search of better yields and returns. Some of them made these investments by borrowing in yen, selling the yen, and investing the proceeds in high-yielding foreign bonds or even US and other stock markets. As an example, a stockbroker in Tokyo was recently quoted as saying he gets more questions from clients about buying Tesla stock than Toyota. This same practice and related trading strategies had been pursued by certain hedge funds in the US and other countries.

This summer, BoJ started hiking its target rate and has made two hikes of 0.25% each. Although the first hikes didn’t have much effect on the value of the yen (surprising, because higher interest rates tend to attract capital from abroad), when the July US jobs report was released last Friday showing a significant drop in new jobs and a 0.2% increase in unemployment, the prospect of Fed rate cuts being brought forward and the resulting narrowing of the “carry” between Japanese and US rates caused a general movement out of favored assets and purchase of yen by carry traders, putting remaining carry traders in jeopardy of losses.

Here we should mention that the July jobs report isn’t as concerning as it first appears. Hurricane Beryl seems to have influenced the report by perhaps dampening job creation during the month. Approximately half of the increase in the unemployment rate from its recent low is due to additional people entering the labor force and starting to look for work (making them technically “unemployed”). New entrants are a good thing; most will eventually be employed, adding to economic activity and tax receipts. And while a variety of labor statistics have moderated to their pre-Covid levels, we don’t yet have any significant uptick in corporate layoffs.

The combination of labor market softening and inflation moderation (inflation being essentially at the Fed’s 2% target) has cleared the way for the Fed to start cutting interest rates soon, probably as early as its September meeting, as reflected in bond yields. That cut and others to follow should be salutary for the economy and investor sentiment. Having said that, many factors feed into economic and market outcomes, making movements unpredictable. Because the stock market is a forecasting mechanism with emotional supercharging, it’s not hard to imagine that the market becomes unphased by the expected cuts coming to pass and looks for the next new thing to spur excitement and the prospect for greater earnings.

In portfolios, clients have very modest exposure to Japanese stocks, where declines have been strongest. Rebalancing of client portfolios over the past year plus has focused on reducing more volatile funds and adding to quality and yield, which are factors less exposed to the carry phenomenon. While being watchful for developments, we will continue our focus on clients’ financial planning, including diversification of return sources, tax-aware use of various accounts and assets, counseling on retirement preparation and sustainability, and much more. Should you wish to discuss any of the above or need counsel on any matter touching finances, we are confident that we’ll hear from you and look forward to your call.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION AT: KBBSFINANCIAL.COM/NEWSLETTER-DISCLOSURE-INFORMATION/