SEC Form

ADV Part 2A Firm Brochure

This brochure provides information about our firm, our professional qualifications and important aspects of how we provide advice and charge our clients. In this brochure, “we” means our firm, Kutscher Benner Barsness & Stevens, Inc., (“KBBS”).

We are a registered investment advisor (“RIA”) with the U.S. Securities and Exchange Commission. The information in this brochure has not been approved or verified by the SEC or any state securities authority. Registration itself does not imply any level of skill or training.

If you have any questions about the contents of this brochure, please contact Cameron Barsness, Chief Compliance Officer, at (206) 462-6100 and/or cbarsness@kbbsfinancial.com.

Additional information about our firm also is available on the SEC’s website at www.adviserinfo.sec.gov. The CRD number for KBBS is 107475. The SEC’s website also provides information about any persons affiliated with Kutscher Benner Barsness & Stevens, Inc., who are registered or are required to be registered as investment advisor representatives of our firm.

Item 2 – Material Changes

This summary of our brochure, dated March 26, 2024, amends our previous brochure, dated March 31, 2023, and does not contain any material changes.

We will continue to provide our clients with summaries if there are any material changes to this and subsequent brochures within 120 days of the close of our firm’s fiscal year.

Please contact Cameron Barsness by mail, phone (206-462-6100) or email (cbarsness@kbbsfinancial.com) for any of the following reasons:

- To request our brochure.

- To obtain answers to any questions you may have.

Item 5 – Fees and Compensation

Item 6 – Performance-Based Fees and Side-By-Side Management

Item 8 – Methods of Analysis, Investment Strategies and Risk of Loss

Item 9 – Disciplinary Information

Item 10 – Other Financial Industry Activities and Affiliations

Item 11 – Code of Ethics, Participation or Interest in Client Transactions and Personal Trading

Item 14 – Client Referrals and Other Compensation

Item 16 – Investment Discretion

Item 17 – Voting Client Securities

Item 18 – Financial Information

Item 4 – Advisory Business

Kutscher Benner Barsness & Stevens, Inc. (“KBBS”) has counseled individuals, families and trustees since 1992. From our origins we were an early adopter of integrated financial planning under an exclusively fee-for-service arrangement (no commissions). Scott Benner, Cameron Barsness, Ryan Stevens, Gianna Giusti and Kyle O’Connor are the firm shareholders. Professional and educational backgrounds are described in detail in the attached brochure supplement (Form ADV Part 2B). The firm has non-discretionary regulatory assets under management of $513,175,872 as of December 31, 2023.

We emphasize routine financial planning with a distinctively in-depth review and written report, involving and integrating these important determinants of financial success:

- Balance sheet (prepare and updated to include all assets)

- Budgeting and cash flow (12-month forward-looking projection)

- Tax analysis and issue spotting (12-month forward-looking forecast)

- Savings analysis, both for retirement and regular assets

- Portfolio sustainability analysis and spending targets

- Investment policy (establish, review and revise as appropriate)

- Asset allocation (integrate across entire balance sheet as appropriate for investment policy)

- Selection of subadvisors and investment strategies

- Strategies for harvesting employee stock options and dealing with other stock concentration situations

- Performance reports, if feasible for entire investment portfolio

- Insurance and risk management (identify gaps and suggest improvements)

- Estate planning and charitable goals (identify and suggest potential improvements)

The advice we provide is customized for each client. The investment advice for each client is integrated with other financial planning considerations (described above) and affects all of a client’s investment assets. For example, recommendations often involve bank accounts, regular brokerage accounts, employer retirement plans, commercial real estate, private equity and/or debt, annuities, mutual funds, legacy stocks and bonds holdings. Special facets of our advice may touch on environmental, social and governance (“ESG”) investments, private placement funds, insider stock with certain investment restrictions, and other investment approaches that might be unique to a client’s wishes or circumstances.

We believe the success of clients’ financial planning is enhanced when they understand and are involved in their investment strategies. Therefore, we encourage communication as well as client oversight and review of our investment recommendations we make. Accordingly, we seek approval prior to affecting changes to a client’s investment portfolio. In this way, the client retains absolute discretion over all such implementation decisions and is free to accept or reject any recommendations.

In our role as financial counsel, we do not serve as an attorney, accountant or insurance agent, and no portion of our services should be construed as legal, accounting or insurance services. Accordingly, we do not prepare estate planning documents or tax returns and we do not sell insurance products. To the extent requested by a client, we may recommend the services of other professionals for certain non-investment implementation purposes (e.g., attorneys, accountants, insurance, etc.), including certain KBBS representatives in their separate capacities as attorneys (for more information see Item 10 below). If the client engages any recommended unaffiliated professional, and a dispute arises thereafter relative to such engagement, the client agrees to seek recourse exclusively from and against the engaged professional, and the engaged licensed professional will be exclusively responsible for the quality and competency of the services they provided.

Fiduciary Duty and Portfolio Activity

Our firm has a fiduciary duty to provide services consistent with our clients’ best interests. As part of our investment advisory services, we review client portfolios on an ongoing basis to determine if any changes are appropriate based upon various factors, including, but not limited to, investment performance, fund manager tenure, style drift, and/or a change in the clients’ investment objectives. Based upon these factors, there may be extended periods of time when we determine that changes to a client’s portfolio are neither necessary nor prudent.

Client Partnership and Engagement

In performing our services, we are not required to verify information received from clients or from their other professionals. We rely on our clients to notify us promptly if there is ever any change in their situations or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. We believe that it is important for the client to address financial planning issues on an ongoing basis. Our advisory fees, as set forth in Item 5 below, will remain the same regardless of whether or not the client engages with us on matters that fall within the scope of our relationship.

Investment Risk

Different types of investments involve varying degrees of risk, and it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended or undertaken by our firm) will be profitable or equal any specific performance level(s).

Private Investment Funds

As noted above, we may provide investment advice regarding unaffiliated private investment funds. Our role relative to these funds is limited to the initial and ongoing due diligence and investment monitoring services. These private investment funds will be considered in the investment portfolio base for purposes of our investment advisory fee. Our clients are under absolutely no obligation to consider or make an investment in private investment funds, and in fact, many of our clients are not invested in such funds. We acknowledge and make considerable effort to inform clients that private investment funds involve various risk factors, including, but not limited to, potential for complete loss of principal, liquidity constraints, lack of transparency, conflicts and additional fees, including incentive compensation (as laid out in such funds’ offering documents, which will be provided to each client for review and consideration). Unlike liquid investments that a client may own, private investment funds do not provide daily liquidity or pricing. Each prospective client investor will be required to complete a Subscription Agreement, pursuant to which the client shall establish themselves as qualified for investment in the fund, and acknowledging and accepting the various risk factors that are associated with such an investment. For valuation purposes, both for client reporting and calculation of our fees, we use the most recent value reported by the fund sponsor.

Interval Funds

As noted above, we may provide investment advice regarding interval funds. An interval fund is a non-traditional type of closed-end mutual fund that periodically offers to buy back a percentage of outstanding shares from shareholders. These investment funds will be considered in the investment portfolio base for purposes of our investment advisory fee. Our clients are under absolutely no obligation to consider or make an investment in interval funds, and in fact, many of our clients are not invested in such funds. We acknowledge and make considerable effort to inform clients that interval funds involve various risk factors, including, but not limited to, potential for complete loss of principal, liquidity constraints (similar to a private investment) and lack of transparency.

Separate Account Managers/Independent Managers

We typically recommend that clients allocate a portion of their investment assets to investment managers—most typically open-end mutual funds, index funds, closed end funds, and ETFs—who are not affiliated with us and are independent from us, while we render investment supervisory services relative to the ongoing monitoring and review of account performance, asset allocation and clients’ investment objectives. Those managers have separate written agreements with their clients and they have day-to-day responsibility for the active discretionary management of assets under their care, including, to the extent applicable, proxy voting responsibility. The investment management fees charged by independent managers are separate from, and in addition to, KBBS’ advisory fee as set forth in the fee schedule at Item 5 below.

Impact or “ESG” Investing

ESG investing incorporates a set of criteria/factors used in evaluating potential investments: Environmental (i.e., how a company safeguards the environment); Social (i.e., the manner in which a company manages relationships with its employees, customers, and the communities in which it operates); and Governance (i.e., company management considerations through transparency, accounting standards, diversity and inclusion and shareholder engagement). The number of companies that meet an acceptable ESG mandate can be limited when compared to those that do not, and could underperform broad market indices. Investors must accept these limitations, including the potential for underperformance. Correspondingly, the number of ESG mutual funds and exchange-traded funds are limited when compared to those that do not maintain such a mandate. As with any type of investment (including any investment and/or investment strategies recommended and/or undertaken by us), there can be no assurance that investment in ESG securities or funds will be profitable, or prove successful. We generally rely on the assessments undertaken by the unaffiliated mutual fund, exchange traded fund or separate account portfolio manager to determine that the fund’s or portfolio’s underlying company securities meet a socially responsible mandate.

Margin

We do not recommend the use of margin for investment purposes. A margin account is a brokerage account that allows clients to borrow money to buy securities and/or for other non-investment borrowing purposes. The custodian then charges the client interest for the right to borrow money and uses the securities as collateral. The use of margin can magnify both account gains and losses. For fee related calculations, we use the net account value after reducing for margin. For regulatory AUM reporting purposes, we use the gross account value as instructed by the SEC.

Retirement Rollovers-Potential for Conflict of Interest

A client or prospective client leaving an employer typically has four options regarding an existing retirement plan (and may engage in a combination of these options): (i) leave the money in the former employer’s plan, if permitted, (ii) roll over the assets to the new employer’s plan, if one is available and rollovers are permitted, (iii) roll over to an Individual Retirement Account (“IRA”), or (iv) cash out the account value (which could, depending upon the client’s age, result in adverse tax consequences). If we recommend that a client roll over their retirement plan assets into an account to be newly managed by us, such a recommendation could create a conflict of interest if we will earn new (or increased) compensation as a result of the rollover. If we provide a recommendation as to whether a client should engage in a rollover or not (whether it is from an employer’s plan or an existing IRA), we are acting as a fiduciary within the meaning of Title I of the Employee Retirement Income Security Act and/or the Internal Revenue Code, as applicable, which are laws governing retirement accounts. No client is under any obligation to roll over retirement plan assets to an account managed by us, whether it is from an employer’s plan or an existing IRA.

Cybersecurity Risks

The information technology systems and networks that we and our third-party service providers (e.g., ShareFile, Tamarac, eMoney) use to provide services to clients employ various controls, which are designed to prevent cybersecurity incidents stemming from intentional or unintentional actions that could cause significant interruptions in our operations and result in the unauthorized acquisition or use of clients’ confidential or non-public personal information. Therefore, we acknowledge that we are subject to the risk of cybersecurity incidents that could ultimately cause our firm and our clients to incur losses, including for example: financial losses, cost and reputational damage to respond to regulatory obligations, other costs associated with corrective measures, and loss from damage or interruption to systems. Although we have established processes to reduce the risk of cybersecurity incidents, there is no guarantee that these efforts will always be successful, especially considering that we do not directly control the cybersecurity measures and policies employed by third-party service providers. Clients could incur similar adverse consequences resulting from cybersecurity incidents that more directly affect issuers of securities in which those clients invest, qualified custodians, governmental and other regulatory authorities, exchange and other financial market operators, or other financial institutions.

Cash Funds

Custodians, including Schwab, often place cash proceeds from account transactions and deposits into a cash “sweep” account. At Schwab, this sweep is actually an internal transfer to Schwab Bank, which is then covered up to $250,000 via FDIC insured banks. The yield on the sweep cash is generally lower than what is available via position traded money market funds. We regularly work with clients to manage their cash between sweep and position traded funds, taking into account any yield dispersion between the sweep cash and a money market funds, an indication from the client of an imminent need for such cash, if the client has a demonstrated history of writing checks from the account, and/or whether cash is held for fee billing purposes. Our clients remain responsible for yield dispersion/cash balance decisions and corresponding transactions for cash balances maintained in any unmanaged accounts and away from our primary custodians (i.e., Schwab).

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding our advisory business or related issues.

Item 5 – Fees and Compensation

Fee Arrangements

Most of our clients compensate us with a fee that is recalculated when we conduct our portfolio review and/or financial planning process. Our standard fee arrangement covers financial planning services including phone calls, meetings, and activities associated with financial counseling and appropriate monitoring of their accounts throughout the year. This “fixed fee” arrangement has served us and our clients well through time, allowing us to consider special factors for fair and reasonable compensation. In assessing what is a fair fee, we typically apply the standard schedule to a client’s “investment portfolio” and then adjust as appropriate.

On occasion, when making more substantial adjustments from the schedule, we consider the complexity of the relationship, the time, effort and skill required to perform the necessary work, anticipated future earning capacity, as well as the responsibility entailed in providing financial counseling services. As a result of the above, similarly situated clients could pay different fees and similar advisory services may be available from another investment advisor for similar or lower fees.

“Investment Portfolio” Base

Subject to the negotiated adjustments described above, the following standard schedule is applied to a client’s “investment portfolio,” which typically includes all assets held predominantly for investment return, including cash, which we view as an asset class. An investment portfolio does not include a client’s residence, personal use vacation home, cars or other property held solely for personal use. Client-owned businesses are usually excluded, and client-owned rental/investment real estate may be considered part of the portfolio depending on the need for related financial counsel. The market value reflected on periodic account statements issued by the custodian may differ from the value used by us for advisory fee calculation purposes.

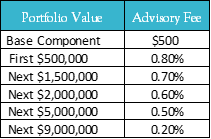

Standard Schedule

Set-Up Fee (Initial Year)

This one-time fee covers initial information-gathering, issue identification, reports, letters and meetings associated with our becoming acquainted with a client’s overall financial situation. The fee is generally equal to 35% of the annual fee, subject to a $2,000 minimum and a cap of $10,000. It may be waived in some cases if we determine that the typical set-up process is not required.

Special Circumstances

Limited Scope. We also provide some clients with a more limited scope engagement, which typically focuses less on financial planning and more on investment advice. Under this arrangement, we waive the base component and simply charge clients 0.7% of the investment portfolio.

In cases where the family relationship exceeds $5 million, a limited scope engagement may be charged 0.5% of the investment portfolio. Note that this discount does not carry over to our standard schedule for financial planning relationships.

Inflation Adjustment. In some instances, our fixed fee compensation arrangement is adjusted at the time of the review/report based solely on changes in inflation (CPI) rather than changes in a client’s investment portfolio.

Other Arrangements. We don’t typically provide financial counseling services for limited-duration projects, and generally we don’t charge by the hour. We make exceptions from time to time at these hourly rates:

- Professional Financial Planner: $500

- Financial Associates: $350

Discounted, Donated and Pro Bono Services

We may provide pro bono advice to non-profit organizations, individuals, family members, and/or may provide planning or advice to employees (of our firm or of the KHBB Law Firm or “KHBB Law”) at a reduced cost. In addition, certain pre-existing clients have agreed to a service offering different from those described above.

Other Costs/Fees

We receive no other fees or costs from clients or third parties including commissions or other arrangements. Clients pay their brokerage firm transaction fees and subadvisor expenses (for example mutual funds, exchange traded funds, private equity and/or debt funds) directly or indirectly, custodial fees, deferred sales charges, odd-lot differentials, transfer taxes, wire transfer and electronic fund fees, and other fees and taxes on brokerage accounts and securities transactions.

Since these third-party charges affect net investment performance, we quantify them in the reviews and written reports we provide to clients.

Clients have the option of purchasing securities recommended by us through other brokers or agents that are not affiliated with us (called directed brokerage). Please see Item 12, “Brokerage Practices” for additional information.

Payment and Timing of Fees

The specific manner in which fees are charged is established in a client’s written agreement with us, and we provide any update to our fees in our financial reviews. Fees are generally withdrawn in advance of each calendar quarter directly from client accounts, and notice of the fee withdrawal is noted in the client’s custodian’s account statement. In some cases, clients are billed for fees already incurred but not yet collected. Client relationships initiated or terminated during a calendar quarter will be charged a prorated fee. Upon termination of a client relationship with us, any prepaid, unearned fees will be promptly refunded, and any earned, unpaid fees will be due and payable at that time.

Expense Ratios

Mutual funds, private funds, and exchange-traded funds also charge internal management fees, which are disclosed in the funds’ prospectuses. Such charges, fees and commissions are exclusive of and in addition to our fee, and we do not receive any portion of these commissions, fees, or costs. We routinely recommend no-load, institutional share class funds as we endeavor to reduce portfolio costs where possible. The average-weighted expense ratio for a client portfolio is typically around 0.7%.

Custodian Fees

As discussed in Item 12 below, when requested to recommend a custodian for client accounts, we generally recommend Schwab. Broker-dealers such as Schwab charge brokerage commissions, transaction, and/or other fees for effecting certain types of securities transactions (i.e., including transaction fees for certain mutual funds, and mark-ups and mark-downs charged for fixed income transactions, etc.). The types of securities for which transaction fees, commissions, and/or other type fees (as well as the amount of those fees) shall differ depending upon the custodian. While certain custodians, including Schwab, generally do not currently charge fees on individual equity transactions (including ETFs), others do. There can be no assurance that Schwab will not change its transaction fee pricing in the future. These fees and charges are in addition to our investment advisory fee and we receive no portion of these fees/charges.

Cash Positions

We have treated and will continue to treat cash as an asset class. As such, unless determined to the contrary, all cash positions (sweep, money market funds, checking, saving etc.) shall continue to be included as part of assets under management for purposes of calculating our advisory fee. At any specific point in time, depending upon perceived or anticipated market conditions/events (there being no guarantee that such anticipated market conditions/events will occur), we may maintain cash positions for defensive purposes. In addition, while assets are maintained in cash, such amounts could miss market advances. Depending upon current yields, at any point in time, our advisory fee could exceed the interest paid by the client’s money market fund.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding compensation-related issues.

Item 6 – Performance-Based Fees and Side-By-Side Management

We do not charge performance-based fees, meaning fees that are based on a share of the appreciation in or returns on clients’ investments.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding fee-related issues.

Item 7 – Types of Clients

Description

Our clients are generally individuals, families and trustees. New clients are accepted on the basis of their alignment with our philosophy and process. New clients generally must have sufficient assets to support an annual fee of $10,000; however, we may accept new clients with a smaller amount of investment assets where clients have a reasonable prospect of adding significantly to their investment portfolios over time (i.e., anticipated future earning capacity, anticipated future additional assets, dollar amount of assets to be managed), are related to existing clients, or where we determine the relationship is otherwise merited on both sides.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding client-related issues.

Item 8 – Methods of Analysis, Investment Strategies and Risk of Loss

Investment Philosophy

We believe successful investing is built on a foundation of financial fitness, paired with reasonable expectations and fidelity to enduring principles.

Investor failure is often rooted in lack of understanding of their goals, their underlying financial fitness and market behavior. It can be countered by giving attention consistently to an array of interrelated financial planning topics, not just focusing on investments. Our outreach, accessibility and disciplined review process often reduce anxiety and help clients stay on course, despite the ever-present sirens of media hype, superstition, mythology, cocktail-party chatter and the dangerous effects these play on human emotions.

We want clients and potential clients to understand this philosophy, which can be customized to fit clients’ varied experiences and views. Substantial alignment of philosophy is important because investment advising is a two-way process. It only really works if the advisor understands the client and vice versa.

Investment Process

One of our goals is to make the investment process as simple as clients desire without neglecting important issues, remembering that investments are just one aspect, albeit an important one, of their whole financial plan. Typically, the process involves the following steps:

- Initial Information Gathering. We begin by gathering information about the client’s current financial affairs, needs, constraints and unique circumstances. We seek their participation and help by asking them to prepare a confidential fact sheet prior to our first meeting.

- Balance Sheet & Asset Allocation Reports. We distill their information into preliminary reports that assist us (and them) in understanding their current situations.

- Forecast Cash Flow & Taxes. We develop a realistic forward-looking cash flow forecast (usually 12 months) and a tax forecast.

- Issue Identification. We analyze themes and relevant challenges to frame the financial issues that we observe or that are of particular concern to clients.

- Determining Goals & Expectations. We work with clients to establish reasonable financial goals and develop reasonable expectations. We prepare an assessment of their savings needs or anticipated cash flow in retirement. We typically use multiple scenarios to compare our conclusions and make recommendations.

- Asset Allocation & Optimization. We recommend a mixture of investments after analyzing clients’ goals and their tolerances for such unknowns as market volatility, inflation, interest rate and currency fluctuations and credit risk. We use proprietary asset allocation models that incorporate modern portfolio theory and take into account behavioral economics, asset location, and costs.

- Manager Recommendations. We typically recommend two or more specific asset managers for each asset class represented in our recommended allocation. We use a mix of active and passive management, open end mutual funds, closed end funds, and ETFs and may recommend other specialized investments depending on investment opportunities, liquidity needs and other factors. We may provide counsel regarding investments in private equity and/or debt, hedge funds, fund-of-funds, and other private placements. In reviewing and monitoring managers, we use third-party research, interviews with fund managers and our own in-house research.

- Reports. We strive to prepare reports every 12 to 18 months, providing a plan that details clients’ financial data. These reports may include a balance sheet, investment returns, expected cash flow and taxes for the coming 12 months, long-term investment policy (allocation), historical returns and volatility, specific manager recommendations, recommended use of tax-deferred accounts, spending and savings forecasts, stock options and restricted stock strategies and summaries of insurance coverage, estate planning, and charitable giving strategies. This report is sometimes provided in separate parts as elements of the plan are reviewed and implemented throughout the year.

- Implementation. Upon approval from the clients, we coordinate the opening of any brokerage or custodian accounts, communicate trade information to the broker and custodian, and otherwise assist clients in implementing the agreed upon recommendations.

Risks of Our Approach

Although a systematic, disciplined approach to investing minimizes the risk of loss over long periods of time, clearly, all investing involves risk of loss that clients should be prepared to bear.

In our experience, poor outcomes for clients are most often the result of their spending habits in relation to the size of their investment portfolios as opposed to investment loss. So, although our approach will improve transparency in clients’ financial affairs, they must still exercise discipline in their spending in order to benefit from our services, or the services of any financial advisor.

The first step in our investment approach is to explore the client’s need for returns and their financial and emotional ability to withstand volatility in their portfolio. That exploration leads to the selection of an investment policy articulated in terms of broad allocations to cash, debt (bonds) and equity (stocks); although on a tactical level, other assets, such as real estate, private assets, and commodities may also be used. If clients misjudge their sensitivity to market volatility, there is a significant risk of loss if, for emotional reasons or otherwise, they reduce exposure to securities (especially equity) after a decline.

Because our investment work for clients is focused on investing their assets (including assets in 401(k) and other tax-deferred accounts) in primarily liquid investments, the presence of large, illiquid assets (such as employee stock options, private companies or investment real estate properties) in client portfolios will have the effect of diminishing overall reliability of return and volatility expectations of our investment models. This is a matter that we address with clients who have such assets, yet the increased risk associated with those assets remains until they are sold. Unfortunately, because the assets are illiquid, the true effect of holding them cannot be known until they are sold.

Our investment policy models and the description of risk and return are based on historical data. We acknowledge that certain financial developments have no direct precedent in history, and thus historical models must be used with care. Clients risk placing undue reliance on average returns and overlooking the significant differences (either higher or lower) in returns that can persist for long periods, such as 10 years. Likewise, there is a tendency among investors to ignore or over-emphasize extreme returns, such as the stock market crash from 2007-2009, because such events are rare.

Tamarac and eMoney

In the event that we provide clients with access to an unaffiliated vendor’s website and the site provides access to information and concepts, including financial planning, the client should not infer that such access is a substitute for services provided by us. Rather, if the client utilizes any such content, the client does so separately and independently from our more tailored services.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding analysis- and process-related issues.

Item 9 – Disciplinary Information

None. Our owners, staff and affiliates have no legal or disciplinary events that would be material to your evaluation of our firm or the integrity of our management.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding disciplinary-related issues.

Item 10 – Other Financial Industry Activities and Affiliations

Financial Industry Activities

None of our owners or staff is registered as a broker dealer or a registered representative of a broker dealer, and none of us has an application pending to register.

Affiliations and Conflicts of Interest

Scott Benner maintains a law practice through a law firm, KHBB Law, PLLC, with which we share office space. Mr. Benner’s law practice, which constitutes about one tenth of his professional time, focuses on estate planning, “angel” investments and other privately negotiated investment and business transactions.

The law practice of Mr. Benner is useful to our clients and the complexion of advice that the firm can give because many clients have issues and concerns that intersect finance and the law. A number of our clients find it convenient or preferable to use the legal services of Mr. Benner through KHBB Law, while many other clients use other law firms for their legal needs.

Confusion about whether Mr. Benner is acting as financial advisor or as lawyer is substantially reduced by (1) his using a separate email address, electronic signature and printed letterhead for written communications in the law and financial practices; and (2) his standard protocol that a person execute an engagement letter with KHBB Law describing service and fees, if they wish to obtain the legal services of Mr. Benner. No client is under any obligation to engage Mr. Benner or any other member of KHBB Law to provide legal services. Our potential offer to a client to engage him or another member of KHBB Law for legal services presents a conflict of interest because they may derive an economic benefit from such engagement. Clients are reminded that they may obtain legal services from any other law firm of their choice (or that we may recommend). Any client engagement of KHBB Law is separate and independent of our services, per the terms and conditions of a separate written agreement between the client and KHBB Law. There is no fee sharing arrangement between our firm and KHBB Law.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding affiliation-related issues.

Item 11 – Code of Ethics, Participation or Interest in Client Transactions & Personal Trading

Fiduciary Duty

As a fiduciary, our firm has a duty of utmost good faith to act solely in the best interests of each of our clients. Our clients entrust us with their assets, which in turn places a high standard on our conduct and integrity. Our fiduciary duty compels all employees to act with the utmost integrity in all of our dealings. This fiduciary duty is the core principle underlying this Code of Ethics Policy, and represents the expected basis of all of our dealings with our clients.

Code of Ethics

The Code of Ethics includes provisions relating to the confidentiality of client information, a prohibition of insider trading, restrictions on the acceptance of significant gifts, the reporting of certain gifts and business entertainment items, and personal securities trading procedures, among other things. All supervised persons at our firm must acknowledge and agree to the terms of the Code of Ethics upon their hire or when the Code of Ethics is amended.

Our clients or prospective clients may request a copy of the firm’s Code of Ethics by contacting Cameron Barsness.

Personal Trading

Our investment recommendations consist of publicly available mutual funds, ETFs, publicly available funds-of-funds and privately subscribed registered investments. Because the publicly traded mutual funds and ETFs have no significant supply constraints within the context of the quantity of assets for which we advise or which are located in our employee’s accounts and are priced at fair market value of the underlying securities, they are identified as “exempt securities” in our Code of Ethics. As exempt securities, employees may trade in such securities without preclearance from the Firm’s compliance officer. If an employee wishes to purchase or subscribe to an IPO, private placement, semi-liquid interval fund or a company stock of which a client is employed, the employee must get pre-clearance from our firm CCO.

In all circumstances, our employees must comply with the Code of Ethics when trading for their own account. Subject to satisfying this policy and applicable laws, our officers, directors and employees may trade for their own accounts in securities which are recommending to and/or purchasing for our clients. The Code of Ethics is designed to assure that the personal securities transactions, activities and interests of our employees will not interfere with (i) making decisions in the best interest of advisory clients and (ii) implementing such decisions while, at the same time, allowing employees to invest for their own accounts. Employee trading is continually monitored under the Code of Ethics to reasonably prevent conflicts of interest between our clients and us.

Privacy Policy

We respect the privacy of all clients and prospective clients (collectively termed “clients”), both past and present. It is recognized that you have entrusted our firm with non-public personal information, and it is important that both access persons and clients are aware of firm policy concerning what may be done with that information.

We collect personal information about clients from the following sources:

- Information clients provide to complete their financial plan or investment recommendations;

- Information clients provide in engagement agreements, questionnaires and other documents completed in connection with the opening and maintenance of an account;

- Information clients provide verbally; and

- Information received from service providers, such as custodians, about client transactions.

We do not disclose non-public personal information about our clients to anyone, except in the following circumstances:

- When required to provide services our clients have requested;

- When our clients have specifically authorized us to do so;

- When required during the course of a firm assessment (i.e., independent audit); or

- When permitted or required by law (i.e., periodic regulatory examination).

Within our firm, access to client information is restricted to personnel that need to know that information. All access persons and service providers understand that everything handled in our offices is confidential and they are instructed not to discuss customer information with someone else that may request information about an account unless they are specifically authorized by the client to do so. This includes, for example, providing information to children about a parent’s account.

To ensure security and confidentiality, we maintain physical, electronic, and procedural safeguards to protect the privacy of customer information. Cameron Barsness, Chief Compliance Officer, remains available to address any questions that a client or prospective client may have regarding the above arrangement. Please contact Cameron to request a separate copy of the above referenced privacy policy.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding ethics-related issues.

Item 12 – Brokerage Practices

Selecting Brokerage Firms

For clients in need of brokerage and custodial services, we routinely recommend Charles Schwab and Company, Inc. (“Schwab”), but we do not require clients to use this custodian, and we have no affiliation with any brokerage firm as our preferred custodian. Custodians, like Schwab, do not charge separately for custody relationships but are typically compensated by account holders through commissions or other transaction-related fees for securities trades that are executed through the custodian or that settle into custodian accounts. We endeavor to advise clients as to all costs and benefits of alternative arrangements. We are not a broker-dealer and do not receive commissions, services, economic benefits, or other compensation for making such recommendations. We do not receive a fee or any material form of compensation for recommending client relationships with a certain custodian.

Clients do not pay more for investment transactions effected and/or assets maintained at Schwab. There is no corresponding commitment made by us to Schwab or any other any entity to invest any specific amount or percentage of client assets in any specific mutual funds, securities or other investment products as result of the above arrangement

Non-Soft Dollars Economic Benefits

We do not accept referral compensation from a service provider that we may recommend to our clients. We receive a range of additional services and discounts from Schwab through their institutional brokerage platform. These include software and other technology that provide access to client account data (such as trade confirmations and account statements), trade execution facilitation (and allocation of aggregated trade orders for multiple client accounts), research, pricing information and other market data, payment of our fees from its clients’ accounts, and assistance with back-office functions, recordkeeping and client reporting. Many of these services generally may be used to service all or a substantial number of our accounts, including accounts not maintained with the custodians. Schwab also makes available various support services. These services may include consulting, publications and conferences on management, information technology, business succession, regulatory compliance, and marketing. In addition, the custodian may make available, arrange, and/or pay for these types of services rendered to us by independent third parties. The custodian may discount or waive fees they would otherwise charge for some of these services or pay all or part of the fees of a third-party providing these services to us. Some of those services help us manage or administer our clients’ accounts, while others help us manage and grow our business. These may also benefit our advisory firm but may not directly benefit a client account beyond addressing our firm’s operational stability.

While as a fiduciary we endeavor to act in our clients’ best interests, our recommendation that clients maintain their assets in accounts at the custodian could be influenced by availability of some of the foregoing products and services and not solely on the nature, cost or quality of custody and brokerage services provided by the custodian, which can create a potential conflict of interest.

Order Aggregation

On occasion, when initiating a transaction in all client portfolios, trades in the same security will be bunched in a single order (a “block”) in an effort to obtain best execution at the best security price available. When employing a block trade:

- We will attempt to fill client orders by day end;

- If the block order is not filled by day-end, shares will be allocated to underlying accounts on a pro rata basis, adjusted as necessary to keep client transaction costs to a minimum and in accordance with specific account guidelines;

- If a block order is filled (full or partial fill) at several prices through multiple trades, an average price and commission will be used for all trades executed;

- All accounts receiving securities from the block trade will receive the average price; and

- Only trades executed within the block on the single day may be combined for purposes of calculating the average price.

Directed Brokerage

We do not accept directed brokerage arrangements (when a client requires that account transactions be effected through a broker other than Schwab). In such client arrangements, a client may pay higher commissions or other transaction costs or greater spreads, may receive less favorable net prices, may have reduced access to institutional share classes than would otherwise be the case. Transactions for directed accounts will generally be executed following the execution of portfolio transactions for non-directed accounts.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding brokerage-related issues.

Item 13 – Review of Accounts

Our clients’ financial plans, including their accounts and asset allocations are generally reviewed annually. We are primarily responsible for communications with clients regarding these matters, unless explicitly agreed upon from the start of an engagement, and most written reports are reviewed by at least two shareholders of the firm prior to being issued to the client.

Clients’ reports usually, but not always, cover a review of recent financial market activity, investment performance of accounts (including benchmark data), cash flow forecast (budget), federal tax forecast, investment policy restatement and statistical profile, projection of portfolio value in the future (including retirement), reallocation of accounts, client balance sheet, proposed trading plan, insurance coverage profile and summary of estate plan. Additional significant financial issues relevant to the client may also be included. Clients under our more limited scope agreement receive a briefer report (possibly in letter or email form) focused on investment management and portfolio reallocation in lieu of the larger report described previously.

Clients can, and are encouraged to, contact us anytime for advice on financial topics without any additional charge, except those under which the agreement specifically charges hourly. In the course of dealing with specific issues, account reviews will often be undertaken.

As discussed previously, we will review client portfolios on an ongoing basis to determine if any changes are necessary based upon various factors, including, but not limited to, investment performance, fund manager tenure, style drift, and/or a change in the client’s investment objective. Based upon these factors, there may be extended periods of time when our firm determines that changes to a client’s portfolio are neither necessary nor prudent, and as such, there may be extended periods of time when we do not communicate these findings to clients individually. Of course, as indicated below, there can be no assurance that investment decisions made by us will be profitable or equal any specific performance level(s).

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding review-related issues.

Item 14 – Client Referrals and Other Compensation

Incoming Referrals

We are pleased that the majority of our new clients are generated by existing client referrals. We do not directly compensate a referrer, nor do we maintain any arrangements to compensate non-employees for new client introductions.

Referrals Out

We refer business to estate planning attorneys, accountants and insurance brokers. However, we do not receive monetary compensation or other material forms of compensation for referring clients to such professionals. We also do not pay any person or firm commissions or other items of material value for referring clients to us. If we receive or offer an introduction to a client, we do not pay or earn referral fees, nor are there established quid pro quo arrangements. Each client retains the option to accept or deny such referral or subsequent services.

Non-Referral Lead Generation

Individuals of our firm may hold individual memberships or serve on boards or committees of professional industry associations. Generally, participation in any of these entities requires membership fees to be paid, adherence to ethical guidelines, as well as in meeting experiential and educational requirements. A benefit these entities may provide to the investing public is the availability of online search tools that allow prospective clients to search for individual advisors within a selected state or region. These passive websites may provide means for prospective clients to contact an advisor via electronic mail, telephone, or other contact information, in order to interview the participating member. A portion of these participants’ membership fees may be used so that their names will be listed on some or all of these entities’ websites (or other listings). Prospective clients locating our advisory firm or an associate via these methods are not actively marketed by the noted associations. Clients who find our firm in this way do not pay more for their services than clients referred in any other fashion. Although the firm may pay the employee’s membership fee, the firm does not pay these entities for prospective client referrals, nor is there a fee-sharing arrangement reflective of solicitor engagement.

Custodial Relationship Benefits

As noted in Item 12, we receive a range of additional services, products and discounts from Schwab and other custodians through the institutional brokerage platform and advisor services. Our clients do not pay more for investment transactions effected and/or assets maintained at Schwab (or any other institution) as a result of this arrangement. There is no corresponding commitment made by us to Schwab, or to any other entity, to invest any specific amount or percentage of client assets in any specific mutual funds, securities or other investment products as the result this arrangement.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding referral-related issues.

Item 15 – Custody

Most client assets are held at independent, qualified custodians.

Clients receive at least quarterly statements from the broker dealer, bank or other qualified custodian that holds and maintains client’s investment assets. Clients should contact us if they do not receive statements at least quarterly from their qualified custodian. We urge clients to review their statements carefully against any reports provided by our firm. Our reports may vary from custodial statements based on accounting procedures, reporting dates, or valuation methodologies of certain securities.

In addition, certain clients have established asset transfer authorizations that permit the qualified custodian to rely upon our instructions to transfer client funds or securities to third parties. These arrangements are disclosed at Item 9 of Part 1 of Form ADV. However, in accordance with the guidance provided in the SEC’s February 21, 2017 Investment Adviser Association No-Action Letter, the affected accounts are not subject to an annual surprise CPA examination.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding custody-related issues.

Item 16 – Investment Discretion

We seek prior approval to effect changes to a client’s investment portfolio. In this way, the client retains absolute discretion over all such implementation decisions and is free to accept or reject any recommendations.

Clients engage us on a non-discretionary investment advisory basis and thus must be willing to accept that we cannot effect any account transactions without obtaining clients’ prior consent. Therefore, in the event that we would like to make a transaction for a client’s account (including in the event of an individual holding or general market correction), and the client is unavailable, we will be unable to effect the account transaction.

Trading authority is routinely obtained pursuant to a Limited Power of Attorney.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding discretion-related issues.

Item 17 – Voting Client Securities

Our clients may periodically receive proxies or other similar solicitations sent directly from their custodians or transfer agents. Should we receive a duplicate copy, we do not forward these or any correspondence relating to the voting of our clients’ securities, class action litigation, or other corporate actions.

We do not vote proxies on behalf of our clients’ accounts. We do not offer unsolicited guidance on how to vote proxies, nor do we offer guidance involving any claim or potential claim in any bankruptcy proceeding, class action securities litigation or other litigation or proceeding relating to securities held at any time in clients’ accounts, including, without limitation, to file proofs of claim or other documents related to such proceeding, or to investigate, initiate, supervise or monitor class action or other litigation involving clients’ assets.

We will answer limited questions with respect to what a proxy voting request or other corporate matter may be and how to reach the issuer or its legal representative.

Clients maintain exclusive responsibility for directing the manner in which proxies solicited by issuers of securities that are beneficially owned by them shall be voted, as well as making all other elections relative to mergers, acquisitions, tender offers or other legal matters or events pertaining to their holdings. Clients should consider contacting the issuer or their legal counsel involving specific questions they may have with respect to a particular proxy solicitation or corporate action.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding voting-related issues.

Item 18 – Financial Information

We do not have a financial condition likely to impair our ability to meet commitments to our clients, nor have we or our owners been the subject of a bankruptcy petition. Due to the nature of our firm’s advisory services and operational practices, an audited balance sheet is not required nor included in this brochure.

Business Continuity Plan

Our firm maintains a business continuity and succession contingency plan that is integrated within the organization to ensure it appropriately responds to events that pose a risk of significant disruption to its operations. A statement concerning the current plan is available and can be provided under separate cover.

FOR QUESTIONS: Our Chief Compliance Officer, Cameron Barsness, remains available to address any questions that a client or prospective client may have regarding voting-related issues.