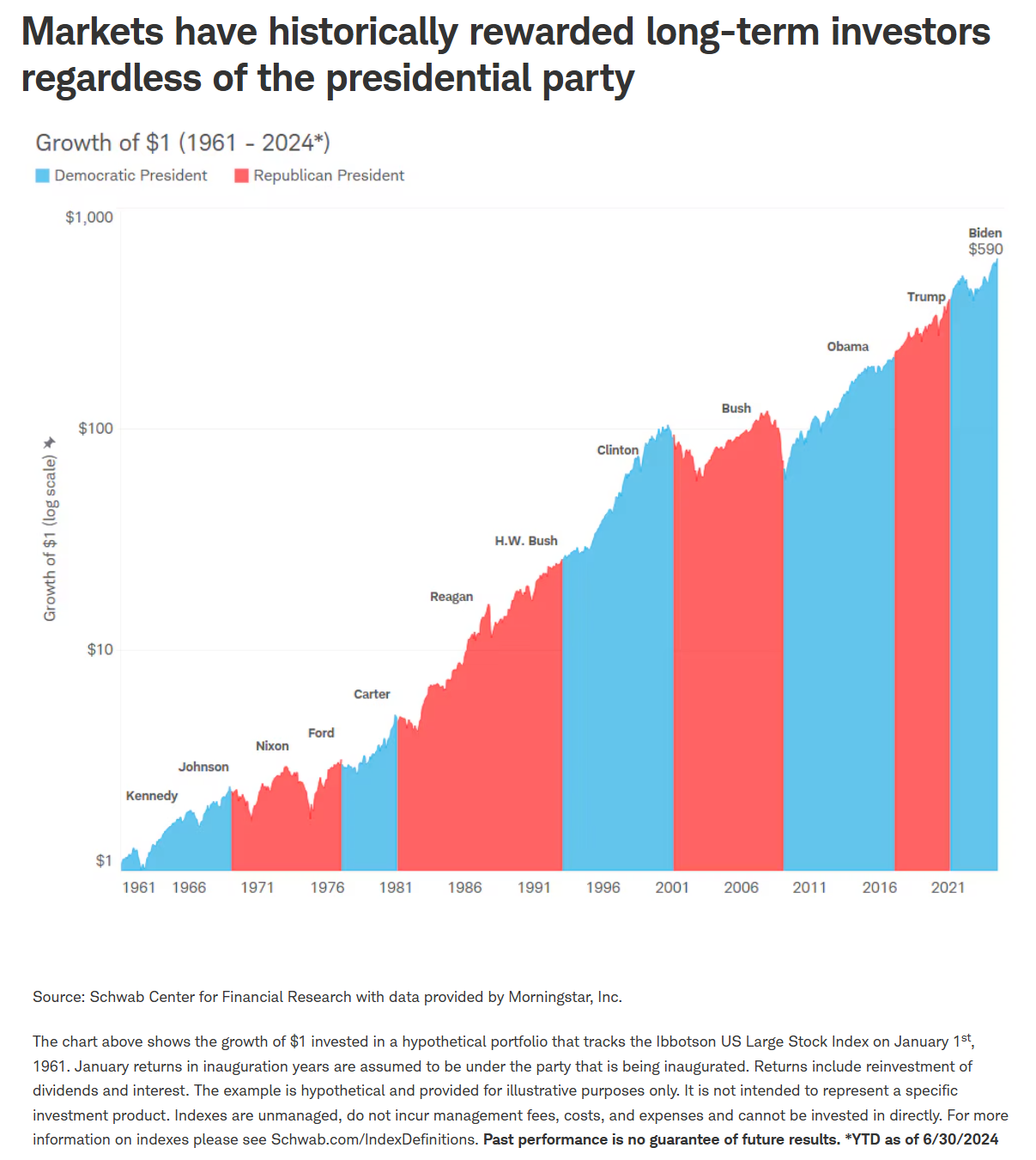

As we approach election day, we expect that many of you, like us, are experiencing varying measures of anxiety, anticipation, hope and apprehension. There are many “what ifs” to contemplate, and some that may keep you up at night, but as we review historical norms, market sentiment, and analytical data, we’re comforted that elections, at least historically, do not have significant long-run consequences for capital markets. The historical record of stock market advance through both Democratic and Republican administrations, as shown below, is pretty compelling as evidence of corporate durability even as the political pendulum has swung. That is not to say that the election won’t have profound consequences for specific groups of people and interests (e.g., taxes or environmental regulation). Thus, we counsel clients to vote their conscience, but not their portfolios.

No matter who wins the Presidency, the prevailing candidate starts from the same place in terms of the strengths and weaknesses of the nation they will lead and in terms of the challenges defined by domestic constraints and foreign conflicts. Both candidates will confront the expiration of the Tax Cuts and Jobs Act in December 2025. Both start with a baseline budget deficit that is already at 6.5% of gross domestic product, a level normally associated with recessions and war. And both will face difficult choices in dealing with our strategic adversaries, Russia, China and Iran. Although Vice President Harris and former President Trump are likely to take quite different approaches to many of those challenges, it is perhaps the “table setting” of a largely common agenda and identical US backdrop that is the greater determinant of outcomes, and that has given us reasonably comparable capital market returns through most presidential administrations.

With this historical record as background, we thought we’d also share some analysis of a few key policy proposals that are perhaps the most economically meaningful and distinctive of the presidential campaign. This comes via the economic forecasting team at Goldman Sachs.

Trump has discussed significantly increasing tariffs on China and potentially raising tariffs against all trading partners, the latter being especially disconcerting. Goldman begins by noting that the president’s tariff powers are limited. Under current law, a president can impose up to a 15% baseline tariff (against all nations) for up to five months. For a longer or higher general tariff, the president needs congressional approval. The Goldman team anticipates a second Trump administration would be more likely to invoke larger tariffs against targeted Chinese goods as opposed to a broad-based higher tariff against all trading partners. Nevertheless, the team forecasts a 0.1% drop in US economic growth and increase in inflation for every 1% change in the overall effective tariff rate, currently near 3%.

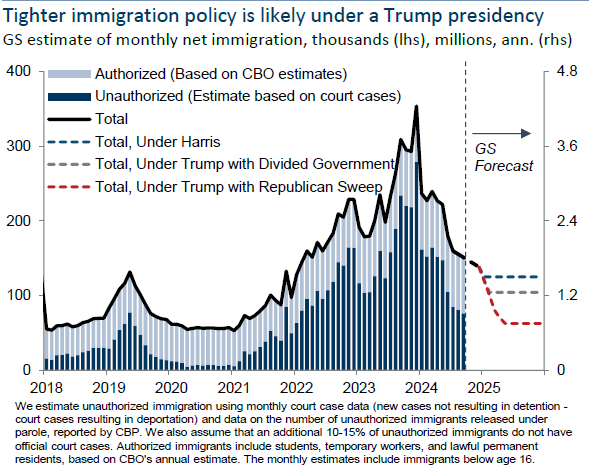

High levels of net immigration have expanded the US labor force in recent years, probably helping contain wage growth that would have otherwise more dramatically pressured inflation. Candidate Trump has proposed a wide-scale increase in the deportation of undocumented immigrants. In either a Harris or Trump administration, Goldman forecasts net immigration numbers to fall, with the lower figure for Trump partially due to increased deportations.

Finally, the candidates have proposed contrasting ideas with respect to corporate taxes. Trump has proposed dropping the statutory rate from its present 21% to 15% and Harris has proposed lifting it to 28%. Goldman Sachs estimates the inverse change to corporate earnings to be slightly less than 1% for every 1% change in the statutory rate.

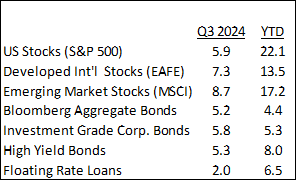

Despite the emotional pitch of this election cycle and some of the more concerning estimated economic consequences of candidate policy proposals, financial markets thus far in 2024 have shown little stress about the coming election. US stocks have advanced briskly in response to earnings, especially among the “Magnificent Seven” stocks (e.g., Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla), while bond returns have generally benefited from higher rates than in recent years, low corporate defaults and the onset of the Federal Reserve’s rate cutting efforts. What volatility has manifested during the advance has emanated from the bond market where participants overestimated the Fed’s enthusiasm for cutting rates, underestimated the strength of the economy or both.

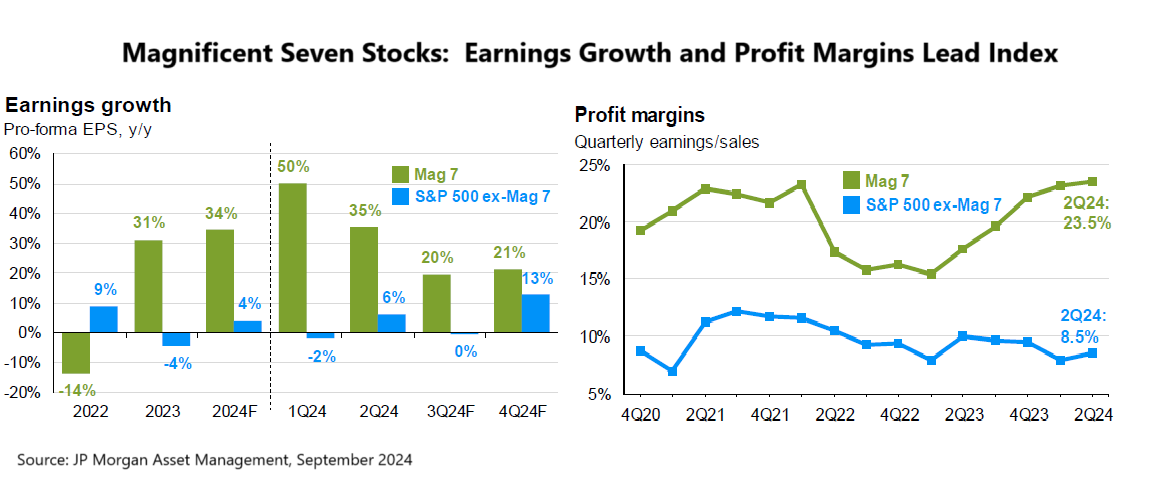

Within the stock market, the fundamental performance of the Mag 7 stocks is truly remarkable as both early beneficiaries and spenders relating to advances in artificial intelligence. These large tech firms also have pricing power that has allowed them to raise prices substantially as part of recent inflation trends. Note the pace of earnings growth and the margins enjoyed by the seven stocks as a group relative to the rest of the S&P 500 Stock Index. This helps diminish, although certainly not eliminate, concern about the thinness of the number of stocks leading the market since their current fundamentals are so noticeably stronger than the remainder, easing somewhat the concern that they might represent a bubble.

Even so, during the quarter ended in September, gains among US stocks broadened out beyond the growth stocks that have led the advance year to date, resulting in our preferred active value managers and the call-writing quality stock portfolio JPMorgan Equity Premium Income ETF (JEPI) outperforming the major S&P benchmark for the quarter.

This performance of the Mag 7 versus the rest of the S&P 500 points to a diversification opportunity between those stocks and the rest of the US stock market. Because they are animated by different drivers, they can be thought of as subclasses of US stocks and invested separately. The diversification represented by low-fee index investments and a few active managers should make for a smoother ride for investors even as it means trailing the market when it moves quickly with just a few stocks.

We also note that international stocks outperformed the US as a group during the quarter. The current global backdrop of US growth during a central bank cutting cycle should normally be good for foreign country economies. Price-earnings ratios and dividend yields on foreign stocks ended the July-September quarter about two standard deviations below and above, respectively, the price-earnings ratio and dividends received on US large-cap stocks, both metrics being indicative of significant relative value in foreign stocks.

Thinking about model allocations more broadly, we are pleased with the outcome of the move to increased low-cost passive stock investment options in combination with a smaller lineup of less volatile active stock managers. We also are pleased with the performance of our fixed income managers who have provided generally benchmark-beating and double-digit returns during the 12-month period ended September 30.

As we come into the end of the year, we will be in touch about a variety of year-end matters depending upon client situations, such as Roth conversions, qualified charitable distributions (QCDs), possible tax-loss sales and other steps to reduce taxation.

In the meantime, as you await the election results, we remind you that short-term market reactions can be swift, but ultimately, holding steady and not overacting or overcorrecting is the best course of action, at least in the short term. We are of course always here to talk through these and other planning matters and welcome your email or call.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION AT: KBBSFINANCIAL.COM/NEWSLETTER-DISCLOSURE-INFORMATION/