As we pick up the pen to share our reflections on the investment environment, our task is to give context and a sense of direction for our approach to managing client investment portfolios amidst increased investor anxiety (measured by mainstream press stories) about the high price of US stocks and whether the pullback reflected in markets in the last days as this letter goes to press is the start of some larger event. While we can’t predict what markets will do in the next day or even in the next year, our task is, and has been, to help clients prepare for how the current environment shapes the probability of investment returns for a variety of assets rolling forward over several years.

We find that investor interest in stocks generally is largely supported by growing corporate earnings, even if earnings growth is concentrated in relatively few companies and the current high level of US stock prices moderates expectations moving forward. And while the current build out of artificial intelligence (AI) computing capacity by so-called hyper-scalers (Microsoft, Open AI, Anthropic, Google, xAI and Meta) is causing concern about the formation of a “bubble” in such capacity or the share price of such companies, the probability of computational power becoming cheap and abundant enhances our expectations for labor productivity, corporate earnings and stock returns over the medium to long-term. Also, growing investor debate, and the current pullback in stock prices, is a healthy check on the intensity of growth in these capital expenditures and heretofore investor enthusiasm that may prove to have been excessive.

Investor anxiety is increased by two discomfiting phenomena that get a lot of press:

- Even apart from the generally high prices of US stocks, there are a growing number of instruments for speculation and clusters of investor enthusiasm for them, whether it is the movement in gold, bitcoin and other cryptocurrencies, or so-called “meme stocks”—typically loss-making consumer facing companies whose stocks are powered for short-term enormous gain by social media influencers. Then there is the proliferation of theme-based products (e.g., “rare earth” ETFs) and levered (2x, 3x) ETFs that follow not just an index, but even a single, volatile stock like Nvidia.

- The current government is a source of disruption rather than a source of policy to address disruptions from elsewhere (e.g., providing stimulus spending or cutting interest rates to address a shock like the Covid pandemic).

The first observation is that there is a timeless element to the intensity of speculation on display. The human impulse to gamble is amazingly powerful, especially considering that risk aversion developmentally must have been well rewarded. Consider that speculation of the type mentioned above and so many more examples exist even as investing in the stock market, for most investors, is more commonplace than ever before with the rise of passive investment funds and even “retirement date” funds that forgo individual stock selection or even asset allocation choices in favor of simple, formulaic accumulation of investment wealth. (This automated buying may contribute to higher stock prices.) More broadly in society, legal gambling is now more widely accessible ( both online and in person) as compared to the late 20th century confines of Las Vegas, Atlantic City and small “off track” betting parlors. Most recently, sports leagues are even promoting gambling, with predictable results for scandal as players and coaches are corrupted by the dollars at stake. This pervasive, narrow and binary betting goes on while what we need to do as a matter of rational behavior is lengthen and broaden the horizon upon which we make our investment judgments.

The second phenomenon causes dissonance for investors as they observe the favorable performance of their investment portfolios while being aware of government policies–such as tariffs, immigrant deportations, and the closure of the federal government–that are viewed by many as economic dampeners even if seen by others as necessary measures. These policies may reflect quite adversely on the political climate for many, contributing to a sense of uncertainty about the country’s direction. The explanation for the disconnect lies in part in the difference between how such people experience these policies as a political matter and the extent to which such policies thus far have actually affected and are forecast to affect corporate earnings given other trends in the economy and capital markets.

And yet, amidst the noise created by these phenomena, we are legitimately in a potentially transformative economic period from proliferation of computing power at a scale way beyond what we have experienced in the journey from invention of the semiconductor to the age of personal computers to the global connectedness of the internet. That change will likely enable businesses that don’t even exist yet while displacing other businesses and a variety of workers. That transformation is understandably attracting a tremendous amount of capital for deployment and intense interest about the ultimate rewards and other consequences of those investments.

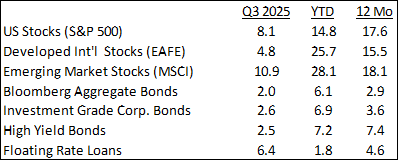

But before we launch into that weighty discussion, let’s share some good news about the rewards to investors over the past quarter, the year to date and last 12 months. In addition to favorable returns in US stocks, foreign stock markets have performed largely on par and at times substantially better than the US market. Some of that better performance has come from the decline in value of the US dollar, as foreign investors this year have started to hedge their currency exposure in a way they hadn’t in recent years (due to the previously high cost from higher interest rates). This technical element is much more observable in the data than the “sell America” theme that was prevalent in the financial press earlier this year.

Advancing stock prices have largely been supported by favorable corporate earnings. Recall that stocks trade at values that reflect the discounting of future cash flows from the profit companies make in their businesses. For S&P 500 Index constituent companies reporting third quarter earnings through October 24th according to economic data company Factset, the rate of growth from the prior year period is 9.2%. For all of 2025, earnings are expected to grow by 11.2% and that increases to 14.1% for 2026. And the growth is not just in the communications services sector (home to most of the biggest tech stocks). Four of the 11 S&P 500 sectors are expected to finish 2025 with double-digit earnings growth and for 2026, seven of 11 are expected to hit that mark. Thus, company earnings do not paint a picture of economic slowdown. Even if earnings for late 2025 and calendar year 2026 don’t grow quite as fast as forecast (perhaps due to policy fallouts), it is not hard to understand why stocks continue to advance, even if the broad measure of the large-cap US stock market (the S&P 500 Index) sells at a multiple of future earnings that is historically quite high at 21.4x (at September 30) versus a median since 2003 of about 16x. The above foundation of earnings is no guarantee against future recession, but it does explain why an advancing stock market makes sense.

AI Infrastructure Buildout. Much ink has been spilled about whether the construction of data centers is excessive such that the hyper-scalers who plan to use and sell this computing power will not be able to make a sufficient return on their investment. This debate and our views can be summarized as follows:

- If data center construction isn’t a bubble yet, it may well become one. The record of constructing fundamentally new infrastructure going back to canals, then railroads and forward to the fiber optic cable boom of the late 1990s is that many participants compete to provide the service, overbuilding in the process and thus driving down the price. Some of the competitors will go insolvent, others may remain wounded for a time and a few may prosper. But the built assets remain.

- The greatest beneficiaries of the new infrastructure will likely not be those companies who pay to build it, but rather those companies who utilize the infrastructure to offer entirely new services enabled by it. For example, the telecoms that provide cable and wireless service to homes and businesses are not the biggest winners of the proliferation of the internet; it is companies like Google, Amazon and Netflix, whose businesses of search, online product sales and on-demand streaming entertainment, were enabled. We likely have not yet seen the businesses that will come to dominate the AI era.

- Cheap and abundant computing power, especially combined with ever improving robotics, promises significant enhancement to labor productivity as lower skilled and physically repetitive jobs are increasingly automated. While there is rightful concern about the consequences for workers in the short run who are displaced, the history of economic development going back centuries strongly suggests that most workers, and certainly new workers, will adapt to other roles, including new roles created as a consequence of the new technology. And some of that productivity gain will accrue to clients and other owners of capital.

- A reconsideration of the AI race may already be underway. In the past 12 months, a broader group of AI-affected companies have seen their stock outperform the Mag 7 stocks. As a pointed example, Meta got a very unfavorable market reaction to its announcement last week of even greater AI spend even as the company’s core business grew 30% from the prior year. Notably, Meta isn’t planning to sell access to an AI engine, like Gemini (Google), Co-Pilot (Microsoft), ChatGPT (OpenAI), Claude (Anthropic) or Grok (xAI).

- When the AI buildout is largely acknowledged as overdone, we expect the stock market will have felt some impact, but a significant portion of the direct write-downs will be absorbed by the private companies mentioned above and their equity backers, which are a mix of venture capital firms, sovereign wealth funds, Softbank and even the Mag 7 companies themselves. AI data center spending is somewhere around 1.5% of GDP, comparable and probably ahead of the peak pace of fiber optic installations in the early 2000s (albeit without signs as yet of the unused capacity in the fiber optic rollout). Thus, eventual reductions in spending will be felt by the current beneficiaries that are involved in construction and equipment supply, and that will reverberate more broadly.

- Despite the disappointment that AI capex retrenchment would bring, there would probably be some relief felt by investors at the increase in available cash flow among the hyper-scalers from their core businesses, cash that presently is going into data center construction and AI-related acquisitions. That construction is largely being funded by hyper-scaler cash means that impact on the bond market is thus far not expected to be serious. That could change if, as Meta did recently, the hyper-scalers start accessing the bond and private credit markets in greater size to fund construction.

Investment Implications. As mentioned at the outset of this letter, our approach to dealing with high US stock prices is to communicate about expectations for future rolling period returns and position client portfolios to reduce the representation of assets that are more likely to provide longer-term disappointment. We have written many times about the historic concentration of the US stock market in a handful of large tech companies, some of which are the “hyper-scalers” mentioned above. Our allocation recommendations reflect a sizable investment in foreign stocks, which are much more reasonably priced than those in the US, and to non-index US stock funds that either reflect a judgment of better value, quality and durability or generate yield as opposed to relying so much on growth. Earlier this year, we added to US small cap stocks based on their relative attractiveness, and that positioning is starting to see some benefits. Finally, we have pulled in corporate loan investments for some clients where past rewards had become overshadowed by increased future risk.

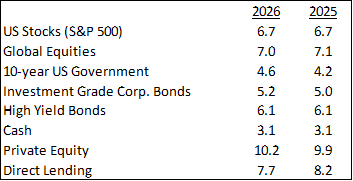

For long-term expectations of rewards, we consider the opinions of a variety of sources. For example, below is a chart of the newly released 10-year rolling period return expectations for various assets as compiled by JP Morgan Asset Management, showing both their expectations as of the start of 2026 and their expectations as of the start of 2025.

Note that longer-term expectations don’t change wildly even as a result of changes in a single year of market performance or as a result of heightened political uncertainty. JPM notes the high starting point for US stocks, which is why the expected average annual return for 10 years is below the historic norm of 9-10%. But they also expect continued strength in capital spending and better productivity while economic nationalism and more restrictive immigration persist. They expect investors to demand more yield for holding US government debt and knock-on positive effects for corporate debt. The 3.1% expectation for cash yield means that they do not expect zero interest rates to be pursued by the Federal Reserve outside brief periods of extraordinary stress. Private equity and direct lending are expected to continue to garner a premium to their public market counterparts, with the rewards of direct lending probably more diffused given the amount of capital devoted to the asset class. We’ll continue to watch private debt for signs of excess risk-taking to compensate for greater competition and lower interest rates

A chart like the above should rightfully be reassuring and yet future returns will likely be volatile as in the past. We are here to help see the volatility in perspective, including partly as the cost of future returns, and to position portfolios for surprises both negative and positive. We’ll be in touch as we pursue your financing planning matters, and in the meantime please contact us with any questions or concerns.