The decline of US stocks the past few weeks is neither cause for panic nor celebration. Rather, pending the development of circumstances making for a compelling trade opportunity (about which we would separately communicate), this is a chance to observe the benefits of investing broadly and limiting the stock concentration that would result from adhering solely to a major US stock index like the S&P 500. Recall the extreme concentration of the index (both in size and 2024 returns) from just 7 technology companies (the “Mag 7”), which we addressed in our prior letter.

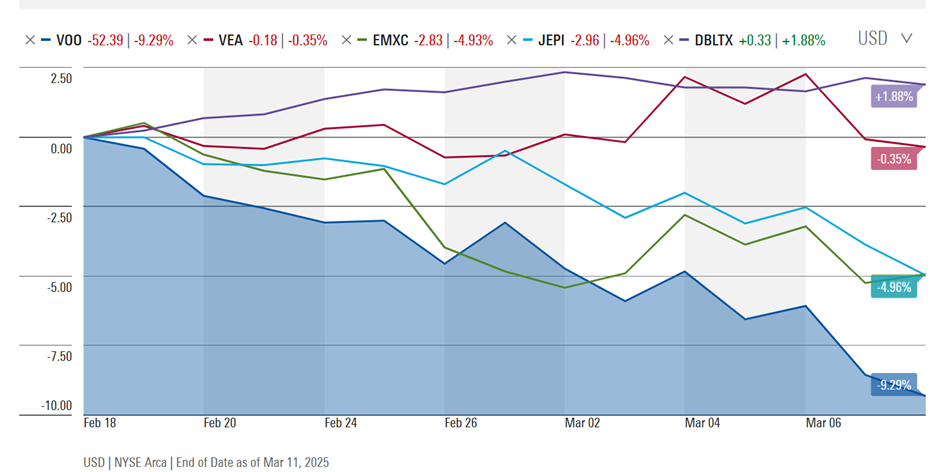

Since their February 19th peak, US large cap stocks as measured by the S&P 500 have retreated approximately 10% through midday on Tuesday, March 11th. This is visible in the dark blue line lowest in the chart below.

The red (VEA for Vanguard FTSE Developed Markets ETF), light blue (JEPI for JP Morgan Equity Premium Income ETF), green (EMXC for iShares Emerging Markets Ex-China ETF) and purple (DBLTX for DoubleLine Total Return Bond) lines represent the path of distinctive alternatives to the US benchmark index that we use to give asset class, geographic and style diversification to most clients’ stock allocations. You can see that bonds (purple) were actually up during the period. Among stocks, developed international stocks (red), driven largely by European and Japanese stocks, have performed best (essentially stable) during this period and the JP Morgan and emerging markets funds (light blue and green) fell only about half the amount of US stocks generally. Not pictured but available by looking up the ticker “MAGS,” the Mag 7 stocks dropped 16% on average during the period.

These differences in performance have helped to cushion and support client portfolios during this period of pronounced volatility as financial markets seek to digest an enormous amount of policy disturbance relating to tariffs, immigration, federal spending and even basic administrative functioning. While we don’t welcome the decline in US stocks (their historic growth power being a big contributor to client portfolios), we do welcome the other parts of portfolios doing their job of diversification. This comes following a year when US stocks, led by the Mag 7 tech giants, left some diversified investors wondering why they own anything other than US tech. To many, it is particularly surprising that European stocks have performed so well given the expectations that tariffs would be tough on Europe’s more export-oriented economy and the increased cost of defense in the wake of the Trump Administration’s move to reduce the US role in European security. While we thought the low prices of European shares would eventually narrow the gap with US stocks, the timing is somewhat unexpected.

This is a good reminder that events are usually unpredictable, even when we think we have an idea of what’s coming. In part, surprising movements in markets (typically an overreaction), whether up or down, can result from seemingly small differences in outcomes that are somewhat less bad or somewhat less good than most people expected. In the case of Europe, their new defense imperative requires increased spending that markets perceive will stimulate their economy and corporate earnings, hence the rise in stock prices.

It’s also a reminder that intra-year declines of 10%, which we build into client portfolio sustainability forecasts, are quite common and can occur at any time, no matter the strength of recent markets (e.g., 2023 and 2024). Famed investor Ray Dalio recently remarked, “Remember that what we know about the future is a lot less than what we don’t know.” That is a useful aphorism in an age when our well-founded beliefs in “what’s right” (in the ultimate sense of human and government behavior) may compel us to expect a particular result from markets. And so, the eventual recovery from this decline could gather steam at any time and for any reason, with the catalyst(s) being unclear until after the fact.

Consequently, we aim to prepare a client’s portfolio (within the context of the client’s risk appetite as reflected in their stock/bond investment policy mix) for a variety of possible outcomes rather than for one expected scenario, though our recommended calibration may emphasize one risk over another. Then, as developments present us with opportunity, we take action, as we’ve done with broad rebalancing trades in past market disruptions (i.e., trimming bonds and buying stocks to return portfolios to their respective investment policies). In the meantime, please be assured that the choice not to react is a deliberate one.

Our financial planning work has rewarded us with strong relationships with our clients. Especially in this challenging time, we are grateful for your trust and for the perspectives and values you share with us. As always, we are just a phone call or email away and hope you will reach out should you desire further conversation around any planning issues or your portfolio specifically.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION AT: KBBSFINANCIAL.COM/NEWSLETTER-DISCLOSURE-INFORMATION/