Dear Clients and Friends of the Firm:

To some of us as kids, and maybe some of us still, there is something compelling about seeing a big digit roll over. Your author can remember a road trip watching with anticipation as the ten-thousand spot rolled on my dad’s 1973 Ford Galaxy 500. A great lumbering beast of a car, my mother once lost control of it in a Minneapolis parking lot after a summer shower. In what seemed like slow motion, its inertial mass could only be stopped by consuming the front end of an oncoming Beetle, which to my 10-year-old mind collapsed with the same ease and fascination as angel food cake. Later examining the Ford, I was amazed that the only sign of anything untoward was a broken plastic grill-piece.

From then on, the car had a supernatural character for me. Just parked in the driveway or garage, its latent power was a reassuring force of constancy in an early adolescence marked by all the normal elements of youthful transition. By my mid-teens, the Ford moved less and less, and one day Dad let some guy chug her down the street for a couple hundred bucks. By then I barely noticed the Ford, but its disappearance made me stop and reflect on the passage of time and on having taken its presence for granted.

Having rolled the ten-spot on the year-count to 2020, it is worthwhile to lengthen our view and reflect on the decade just past and the financial trends that persisted, and consider which of them might, in the passage of time, fade from the scene like that old Ford. With 10 years of economic expansion, the longest in US history and the slowest at about 2%, it is easy to take that slow, constant force for granted and expect things to just continue. But of course change comes, and then we’re surprised.

Review of the Decade Past

Here are the trends that most stand out from the decade just past:

- Low yields for sovereign bonds, including US Treasuries, and even negative yields in Europe and Japan.

- The ascendancy of the US dollar over foreign currencies.

- The faster rise of US stocks compared to international stocks and especially the emerging markets.

- The outperformance of growth stocks over value stocks.

Central Bank Policy. Underpinning these trends was the seeming omnipotence of central banks, especially the US Federal Reserve. To buttress economies barely out of contraction as the decade opened, central banks cut interest rates to near or below zero and purchased massive quantities of sovereign and high quality bonds in order to drive investors into stocks and other riskier assets in search of returns. Doing so would hopefully create a sense of wealth in the public mind, which was supposed to encourage more consumer spending and lower companies’ cost of capital so they would invest and hire more.

International Stocks. As it happened, central banks were very successful in lifting equity prices. Initially, the emerging markets raced ahead on the swell of ample financial market liquidity and enormous Chinese fiscal stimulus applied during the recession. But in 2013, as the Federal Reserve began to reduce its debt purchases and China’s economy cooled, liquidity in emerging markets was squeezed. China hasn’t yet suffered a “hard landing” from its debt and property bubbles (and may never do so), but managing them and navigating to a more consumer-focused economy has cost it growth in recent years and affected other emerging market countries.

Europe started the decade fearing a potential breakup due to the indebted peripheral countries of Greece, Portugal, Italy and Spain, all of which needed currency devaluations but were straightjacketed into the Euro and suffered massive unemployment instead. This reached a fever pitch in late 2011 when European Central Bank (ECB) President Mario Draghi uttered his famous “whatever it takes” defense of the Euro. With the ECB taking its benchmark rate below zero and purchasing massive amounts of European government debt, Europe muddled through the decade until another peripheral country, the UK, voted to depart, a process that has dragged on for years to the point where the certainty of exit founded on Boris Johnson’s recent electoral win seems a non-event to markets.

US Stocks. The US financial markets, other than feeling some of these effects at a distance, suffered none of these problems. Instead, the US stock market has hung on each utterance of the Federal Reserve and has only retreated significantly when the Fed seemed intent on raising rates at a time when the market felt the economy was unprepared. (That sounds like praise for the stock market as a noble guardian of the economy. It’s not meant to be. The stock market is a network of self-interested participants, but in the aggregate at any time they are saying something about how the economy is affecting corporate earnings or how changes in interest rates or other factors are affecting the valuation of earnings.)

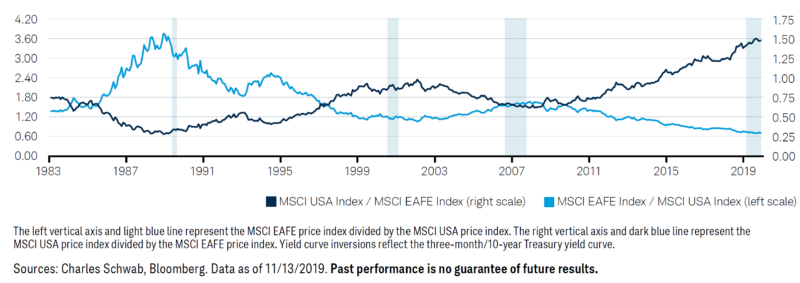

The outperformance of US stocks over foreign stocks during the decade is shown on the right side of the chart above as the dark blue line rises beginning with the shaded area of yield curve inversion in 2007. As you can see, the relative performance of US stocks and foreign stocks has moved in long waves. (More on that later.)

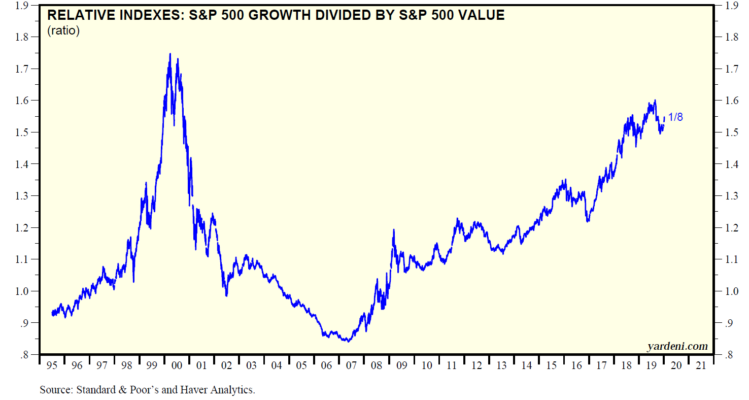

Growth Over Value. In the US, the upward movement in stock prices was most pronounced among growth stocks. For the scale of this, see the chart above, where the rising blue line since 2007 represents growth stocks growing almost twice as much as value stocks.

Who can forget the moniker “FANG,” a convenient (if curiously malevolent) handle for the leading companies in social media, internet retailing, streaming media and search? The search for the newest blockbuster growth stock led to an enormous swell of capital into venture funds, most notably Softbank’s $100 billion “Vision” fund, which showered an entire cohort of “unicorns” with cash to grow like crazy regardless of profit. This mode reached its zenith in mid-2019 when WeWork, whose self-declared mission was to “elevate the world’s consciousness,” attempted to go public, only to find that what investors really wanted was for them to lease space for a profit.

Debt Markets. In debt markets, low interest rates benefited those homeowners able to refinance and raised home prices (especially in technology growth cities) as lower mortgage rates meant buyers could afford to pay higher prices. New home construction and household formation remained stunted for most of the decade as many former workers stayed out of the job market, and most banks radically diminished their lending to property development. The labor market has slowly healed, to the point where wages in the US are rising fastest for the lowest wage workers, but bank regulation continues to limit credit for housing developers and home buyers.

Companies used low rates to borrow vast sums of capital, but generally didn’t do it to invest in their businesses. Instead, they repurchased their own shares. Some of this was natural: capacity utilization in US factories remained low for much of the decade, so investing in more capacity made little sense. And as companies make profits without fully distributing them, some additional borrowing for buybacks is necessary just to keep the debt:equity ratio of their balance sheets consistent. Still, the scale of borrowing by companies has been quite large and represents potential for market stress.

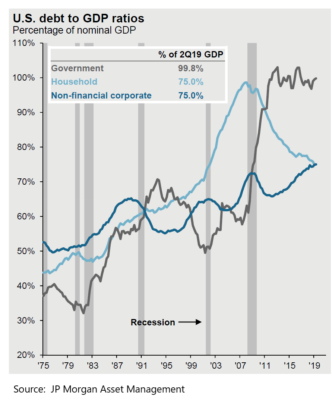

With rates low, governments weren’t compelled to reign in deficit spending initiated during the Great Recession. In the US, we even cut taxes and added spending late in the expansion and now have a high debt burden resembling Europe’s while experiencing the lowest unemployment in generations.

Looking Toward This New Decade

If these are the major themes of financial markets in the 2010s, which of them might fade away (or reverse) in the new decade? And what trends might replace them? And what can you do and how can we help you to prepare for the variety of outcomes that financial markets may bring over the coming year and decade?

Let’s start with some advice that is timeless:

- There will be surprises, maybe mostly surprises. That’s a feature of life, and certainly life in the markets. Recessions and bear markets will come, and they will not be widely anticipated. Among the crowd of forecasters, there will always be someone who seems to have called it right. But separating the skill behind their views from the normal distribution of opinion is impossible.

- Financial stress will be worse among investors who struggle to manage their spending to a scale reflective of their portfolio size and reasonable expectations. We can’t control market outcomes, but we have significant control over our spending and some control over our income while working. We can adjust portfolios to narrow the distribution of possible outcomes, but there is still a high degree of randomness with portfolio returns that isn’t present in spending or earned income.

- We need to be mindful of our biases and seek to resist them. For an interesting read through a catalog of investing biases and phenomena, see http://www.psyfitec.com/p/the-big-list-of-behavioral-biases.html. A few key ones we see a lot and need to resist ourselves include recency bias (the tendency to project recent events into the future), the simulation heuristic (our tendency to weight the likelihood of an event by how easily we can imagine it), the action bias (our preference to act when doing nothing is more rational, perhaps out of a reach for control) and attribution bias (the tendency to see patterns and causes among random events).

But beyond the surprises and timeless admonitions, there are a few trends afoot in economic phenomena that affect the likelihood of particular outcomes for financial markets. We’ve highlighted the major themes by placing them in bold below.

The power of central banks to fight recessions may be reduced. Consider below the chart of the Federal Funds rate, the Fed’s principal policy rate tool. It is remarkable what the scale of “zero interest rates” looks like (2007 to about 2016) compared to the level of the rate in the past.

There is a seeming step-down pattern to the chart as if each new round of rate easing has less effect than the prior cycle. To borrow a 60s slogan, “what if they gave a war (rate cut) and nobody came (cared)?” Certainly, as they have done in the past, central banks can buy up government bonds (the Fed), and even corporate bonds (the ECB) and still yet stocks (the Bank of Japan), but the effect has been to support financial asset prices, rather than to markedly affect economic activity. This pattern doesn’t bode well for a meaningful stimulative effect for rate cuts next time they are implemented and may contribute to greater swings in stock prices as the economy moves through the business cycle.

Thankfully, negative rates (the apotheosis of this thinking) are probably on their way out. Negative rates involve depositors paying banks to hold their money (and simultaneously charging banks for their reserves at the central bank). Negative rates are still the policy of the ECB (although less so recently), but at least the first central bank to adopt them (the Swedish central bank) has abandoned them as they cause people to remove cash from the banking system (and hide it in their mattresses!) and force people to save more to support themselves in retirement. This extra savings inhibits current economic activity.

High levels of government debt may hamper recession-fighting fiscal stimulus and demand low interest rates to maintain government solvency. As shown in the chart above titled “U.S. debt to GDP ratios,” we have a tremendous amount of accumulated government debt. The quick ramp up in debt that started in 2007 as a consequence of tax receipts falling in the Great Recession and stimulus spending has continued due to a variety of congressional budget deals, a drop in the corporate income tax rate and the increasing burden of social programs for seniors. This debt burden makes less likely the willingness of government actors to add stimulus the next time the economy enters recession. Likewise, the high debt level makes servicing the debt more burdensome, especially as interest rates rise. We should anticipate that in the next substantial move upward in bond yields the Federal Reserve will come under pressure from politicians to buy government debt in order to bring yields down. This process is likely to be volatile because the members of the central bank earnestly guard their independence.

A sign of this kind of monetary easing is evident already in the market among banks for overnight money. In late 2019, to avoid a spiking of rates due at least in part to the scale of corporate tax payments, the Fed created a more or less permanent funding facility for participating banks to borrow from the Fed.

Low bond yields obviously diminish the rewards from holding bonds and increase the desire of investors for other assets, like stocks and real estate, where higher returns (and volatility) are expected. It is reasonable to expect that stock prices may tend to stay high, or at least more quickly bounce back after recessions, as investors may feel they have no choice but to tilt their portfolios to owning stocks.

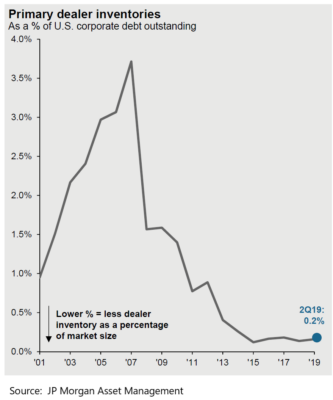

In addition to low yields, the bond market must contend with less liquidity. As shown in the chart below, investment banks and other bond dealers no longer carry the inventory of bonds they once did to meet client orders to purchase or sell bonds for their portfolios. Instead, the banks now act like brokers and go looking for or shop the relevant bonds among their clients. This consequence of post-recession regulation means that we are likely to see bigger swings in bond prices than in the past during periods of recession or other credit stress. This volatility creates opportunity for skillful bond managers, especially those whose structures are relatively insulated from client redemption requests.

To contend with low yields and take advantage of market stress, we have sought to invest in debt securities in idiosyncratic situations and through fund structures that allow the manager to more aggressively manage the portfolio. You’ll be hearing more from us about such managers in 2020.

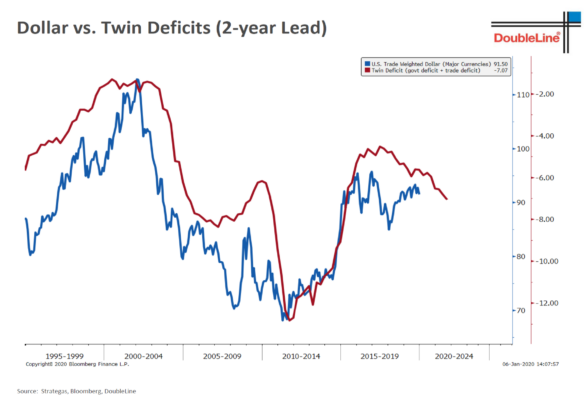

The high level of the US fiscal deficit and the high US trade deficit (the so-called “twin deficits”), imply that the US dollar, which rose overall against other currencies throughout the 2010s, is increasingly likely to decline. The relationship between the deficits and the dollar is seen in the chart below where the movement in the dollar is lagged two years in comparison with the twin deficits.

If the dollar does enter a new long-term trend of weakening, that significantly increases the likelihood that foreign assets, including foreign stocks, reverse trend with the US and start to outperform. As shown in the first chart in this piece, the ascendancy of US and foreign stocks against each other moves in long cycles.

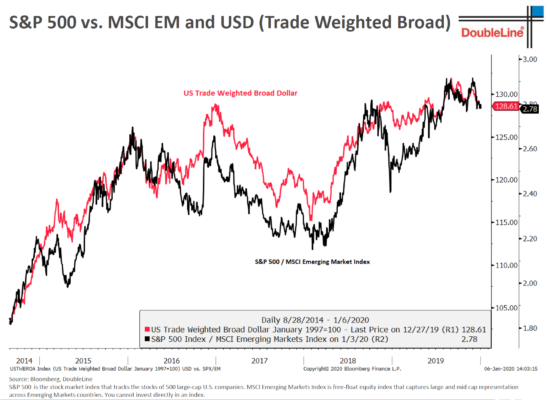

For another look at this relationship, the chart below shows the trade-weighted US dollar in red plotted against the ratio of the level of US stocks divided by emerging market stocks. As the black line goes up, US stocks are becoming more valuable compared to emerging market stocks (by US stocks either rising faster or falling more slowly) and when the black line is falling emerging market stocks are become more valuable than US stocks. One can easily see the relationship between the dollar and these two universes of stocks. This is no surprise as currency moves have historically explained a significant amount of the relative movement in foreign stocks versus US stocks.

Clients should own foreign stocks for diversification purposes, but they might be forgiven for wondering why over the past 10 years. By analogy, in a baseball game, at any moment most of the players seem superfluous; it is only by watching the game over time that the role of each player can be seen. The next decade could bring greater rewards for owning foreign stocks than the past 10 years.

Many European companies are global franchises and on average take greater measures to protect the environmental sustainability of their businesses than US companies. As investment dollars flow increasingly toward such businesses, this may create a tailwind for European stocks. We have recommended PAX Global Environmental Markets as a means of significantly participating in this trend.

Emerging market countries, on average, have advantages in their young demographics and their business-oriented governments and cultures. As the US and China view each other increasingly as strategic rivals and separate into distinct technology worlds, investors will want to participate in the growth of businesses in China and other markets. China’s scale in particular, makes possible some businesses that don’t work in the US.

Having said that, the US remains an incredibly dynamic economy compared with the rest of the developed world, with active innovation communities and deep capital markets. We want clients to participate in US innovation and look to T. Rowe Price New Horizons Fund as well as private equity for the most focused investments in innovative companies.

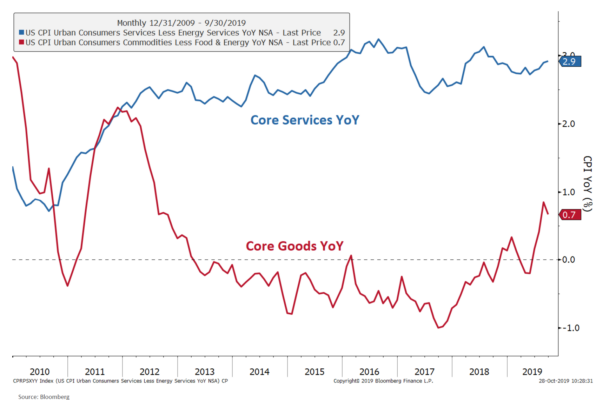

Increased trade friction may contribute to a surprise increase in inflation. “Outsourcing” of manufacturing production or customer service overseas has contributed mightily to keeping down the price of goods, as has competition in retailing brought on by Amazon. Below is a chart comparing the change in the price of goods versus services.

Donald Trump’s expressed antipathy for China in the 2016 election and beyond has changed the desire for trade across the political spectrum. Most of the Republican and Democratic leadership are now trade skeptics. Criticisms of Trump’s trade policies focus more on his tactics than substance. Imagine what reported overall inflation would be like without the dampening contribution of goods inflation. And one can see that the trend in goods inflation is up significantly since late 2017. Already, all but one of the major inflation readings in the US are above the Fed’s target of 2%. Only the Personal Consumption Expenditures Index, the Fed’s preferred measure, is under.

Still, it will take some time for inflation (if it comes) to force the Fed’s hand. Fed Chairman Jerome Powell recently stated: “We would need to see a really significant move up in inflation that’s persistent before we would consider raising rates to address inflation concerns.” Who knows how far and for how long inflation would need to move to get the Fed’s attention. Maybe 1% over a year? Whenever the Fed acts, that will set up the conflict between the Fed’s defense of its mandate and independence and the desire of politicians to control interest on the federal debt. That dynamic may take substantial time to resolve and could have serious financial consequences for many years to come.

* * *

Surely there will be much more to the new decade than we’re imagining, but with the above themes in mind, here are some things that we concentrate on in our financial planning work with clients:

- Keeping a close eye on withdrawal levels and client spending budgets so that withdrawals remain sustainable in the context of realistic return expectations.

- Adding distinctive investment styles (e.g. sustainability technologies and niche lending) and private fund structures to seek investment returns less directly affected by major markets.

- Controlling cost by blending in a healthy dose of passive index funds where that makes sense.

- Managing taxation in investment placement, rebalancing and movements between taxable and tax-deferred accounts (i.e. contributions, distributions and conversions).

- Helping clients stay committed to their investment policies through a future that could be more volatile than we’ve seen the past decade.

We hope the above review and thoughts about what may come is informative to you and helps you understand the work we do for you. If you would like to discuss any of these matters, please let us know. We look forward to working with you in this new year.

IMPORTANT DISCLOSURE INFORMATION

You should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from KBBS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing. KBBS is neither a law firm nor a certified public accounting firm.