Greetings:

The outbreak of the coronavirus known as COVID-19 hasn’t just required attention to financial market volatility; it has also required that we think about and adapt to the way we conduct business.

Operations

First, it is important for you to know that we are open and conducting business. You may be aware that the Seattle city authorities have asked businesses to allow employees to work remotely (from home) as a means of reducing transmission of the virus. Likewise, we are largely working remotely, something all of us have done from time to time before and which we have now done collectively with success. At this point, phone calls are being forwarded to our cell phones or received as voicemail messages that reach us by email, and our postal mail is being picked up and digitized regularly.

Until virus transmission has substantially peaked, we prefer for the safety of our clients, as well as our colleagues, to talk over the phone or by video conference. If there is a matter that you believe requires meeting together we will certainly do that. Note also that we will be sending reports to clients in electronic format, and can provide paper copies once we are back in our physical offices.

Market Check-In

When we last wrote to you on February 28th, the US stock market was off about 12% from its peak. Last week (the first week of March), the market was about flat. Today, the market sank about 7.5%, the worst one-day move since 2008. Adding to the chaos today was the outbreak of a price war in oil (more on that below) and the loss of an hour’s sleep on Sunday due to Daylight Savings Time.

Among our financial antagonists, maybe the loss of sleep had the worst effect today as we know that sleep is critically important to brain function and effective decision making. Our brains are already taxed by stressful events. The normal flight from risk response typically gives us the impulse to avoid the pain by fleeing the activity—selling financial assets in the case of market stress.

Preparing for days like today started quite a while ago, back when together we selected an investment policy having a mix of stocks and bonds and in resolving then to stick to the policy during good times and bad. At times like these, that resolve is tested.

Coming into view is the point where disruption from the virus touches everyone. (Certainly, it has us.) That immediacy of risk, rather than viewing the risk as far across the Pacific, has put a sense of urgency into people’s actions, which (judging from today’s market action) has led to some rash decisions regarding financial assets.

It will take some weeks for transmission to peak and still longer to gauge the effect of dampened activity. To paraphrase Winston Churchill, this feels like the end of the beginning; we are in the throes of it now. Eventually, risk of sickness and disruption from various degrees of quarantine will seem normal. When that happens and announcements are perceived as “less bad,” markets will sniff out the brighter side of things and show their buoyancy.

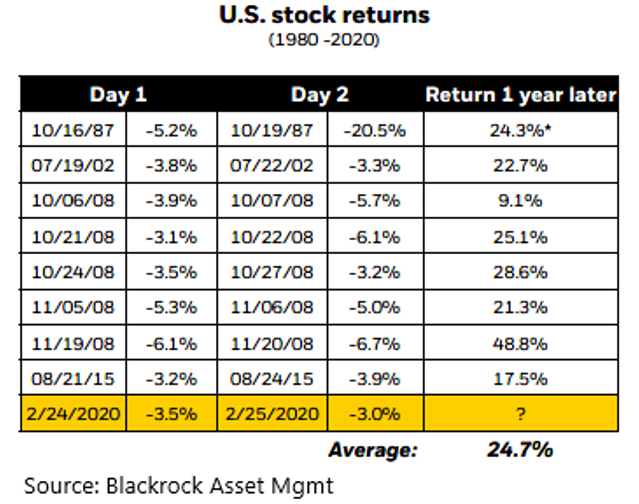

For an example of this, consider below the table showing the one-year recovery following consecutive big down days in the US stock market since 1980. The chart was prepared prior to today, so omits today’s activity, but the general pattern of recovery can been seen nonetheless.

As mentioned at the start, adding to stock market volatility today was the outbreak of a price war over oil. OPEC (led by Saudi Arabia) and Russia have been cooperating for a couple of years to manage oil production and modulate price changes. But they disagree about the appropriate response to COVID-19. The Saudis want production cuts to support prices while Putin is reported to favor lower prices to stress US oil producers (most of whom fracture rock to find oil and need about $40/barrel to make that pay). On Friday, the Saudis responded by slashing their wholesale prices radically below the market trading price in an effort to lock-in future sales.

While we exited direct energy and real asset investments in June 2019, energy companies play a significant role in our economy and financial markets. Of course, oil stocks are down. But so too are bonds of oil companies, and defaults (if low oil prices persist for long) will be felt by lenders. The pain that would be transmitted through the credit system would seem substantially less than home mortgages caused in 2007-2009, but is something to keep an eye on. It gives us comfort that our preferred bond managers hold very few oil company bonds.

As always, we are here to talk through any of this with you and look forward to hearing from you. In the meantime, be safe (and wash your hands).