We write to you here at the end of the first quarter amidst financial markets in great transition. Of course, the battle against the coronavirus walloped financial markets in the quarter, but the initial period of indiscriminate selling has passed. With asset prices down significantly and better data on cases and deaths from early hot spots, markets have found some footing as some investors start to sort through assets for opportunity.

To start, we’d like to revisit some fundamentals that are relevant to our thoughts about what’s happened and “where we are” in terms of moving through the process of financial market adjustment to economic events.

Most fundamentally, declines like we’ve experienced in the first quarter of 2020 illustrate why investors should own mixed portfolios of stocks, bonds and cash (that mix being their investment policy) and why we take care in our discussions with you to understand your cash needs. Cash is necessary to sustain household spending. Without sufficient cash, an asset must be sold to meet obligations, whether those are mortgage payments, college tuition or grocery bills. Bonds are both stabilizers of value in a portfolio and a source of potential cash if, in a prolonged decline, an investor needs to raise additional cash and wishes to avoid selling stocks on the cheap. Stocks are the growth drivers of portfolios, but also the most volatile as recent declines easily demonstrate.

As you know, we tend to favor DoubleLine Total Return Bond Fund for clients’ core bond position (although some clients use another fund in a 401(k) and some may have municipal bonds if they are in a high tax bracket). That fund was essentially flat for the quarter (-0.75%) while US stocks (as measured by the Russell 1000) fell 20%. From the peak of February 19th to the recent low of March 23rd, stocks fell 34%. Notice that an investor can reduce the discomfort of decline by checking a portfolio less frequently.

That stability in DoubleLine allowed us to rebalance most clients toward their investment policies by trimming their bonds and buying more US stocks, which we did on March 18th. At the time, we didn’t know stocks would hit at least a temporary bottom three trading days later. And we still can’t say whether that value in stocks will hold. At the time of this writing, it’s nice to observe that such purchase is “in the money,” but that may be fleeting.

What we can say is that the balance of probabilities that the stocks would be worth significantly more than the bonds at some modest distance in the future, say one or two years, was relatively high and sufficient bonds would remain in client accounts to wait out that unknown period. Thus, the trade was worth doing.

In nearly all stock market declines of the scale we’ve just experienced, stock prices test their recent lows and often go on to decline further. We think it is important for clients to remain realistic about the path of asset prices from here.

Despite this weight of historical precedent, there are at least two reasons why we may have seen the worst from stock prices already. First, a “retest” of the lows is widely anticipated and when “everyone knows” something is about to happen in the markets it is a near certainty that it won’t. (Although we may be misreading market sentiment.) The second reason is that the stock market was amazingly sanguine in the face of the worst jobless claims that have ever been recorded on March 21st and 28th. Below is a chart of jobless claims over the last 50 years and you can see that there is no historical precedent for the scale of job losses that we saw in March.

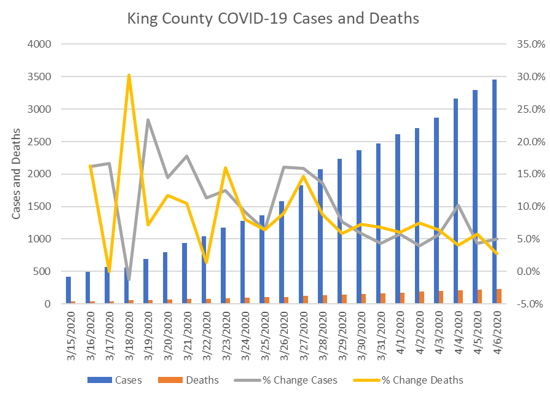

Why would the stock market be so buoyant in the face of historic job losses? Perhaps because, as we anticipated in our late February letter, markets had sniffed out that the growth rate of infections for parts of Europe and early US hot spots were peaking, which was the point when markets in China began to rally. Below are the daily statistics of COVID-19 cases and deaths for King County as published by the State of Washington, which show the diminishing rates of change from day to day in new cases and deaths.

On March 4th, the City of Seattle requested that employers allow employees to work remotely and on March 23rd, Washington’s governor instituted his “Stay Home, Stay Healthy” order. The reduced new deaths in recent statistics reflect lower rates of social engagement since these orders were put in effect. Of course, new cases are just a sample because testing isn’t widely available. Still, reduction in the rate of change is what’s interesting, even if the sample size is smaller than what effective public health management demands. Similar data is coming from California and even New York City, as badly as the Big Apple has suffered.

With the decline in disease transmission and death acknowledged, at least among early hot spots, the stock market may next look for improvement in statistics that narrow and reduce the range of estimated economic fallout. On that score, we probably have many weeks to go. Weekly jobless claims will be the frequent indicator to tell us how the economy is doing on a current basis. In some sense, it will be easy to improve on recent, outrageously high claim figures that have no historical precedent. On the other hand, how low do new claims need to be so that they are “not so bad?” Also, we should recall that employment is normally a lagging indicator and the stock market typically begins a sustained rally when unemployment is still rising.

Behind the employment statistics will be the decisions of companies and individual business owners across the nation, nearly all of whom have had to reduce operations or shut down. Some will never reopen. For those with the means to start again, what is the nature of reopening when the closure was so sudden? Here we have no precedent either. And we should anticipate that some people who either don’t work or can work remotely will maintain some social distance and accordingly exhibit continued frugality. A greater impulse to save may be more widespread in society as a result of two painful recessions in so short a time. Finally, the remote work and video calling made necessary by social distancing may permanently dampen business travel, demand for office space and the services that office workers need.

Despite these uncertainties, emerge from this crisis we will. The US and the world have suffered all manner of unexpected calamities. And owning productive assets, maybe even adding to ownership during these times, will serve investors well as has always been the case as we move from periods of stress to further growth.

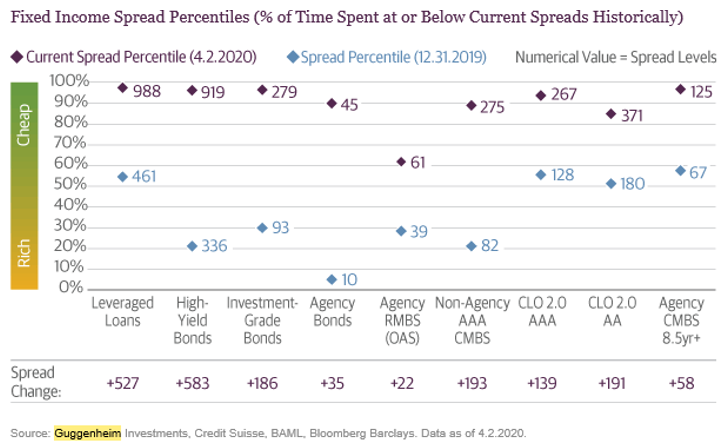

And we should expect that opportunities for attractive return become manifest at different times as we move through this economic contraction. Some of the best early opportunities are in fixed income sectors, as shown in the chart below (wide “spreads” above the rate on US Treasuries represent cheaper bonds). Bonds priced at these levels are reminiscent of the opportunity presented during the Great Financial Crisis, during which corporate credit recovered and provided earlier returns than stocks. As was the case then, we know from calls with our multi-sector bond managers, who experienced markdowns in February and March on corporate, high yield and asset-backed securities, that they have been using their cash reserves selectively to pick up value on the cheap.

Spreads have narrowed this week as the Federal Reserve expanded its quantitative easing program to include many of the above sectors. Still, whether that narrowing has now been reflected in rising values of our bond managers or is still present in selected bond issues, the opportunity in high yield bonds is best summarized by Carl Kaufman, manager of Osterweis Strategic Income Fund, in his recent quarterly commentary:

“For historical perspective, high yield (HY) spreads above 800bp have led to attractive return opportunities, and the case is even more profound above 900bp. The median annualized return over the next 12, 24, and 36 months for HY as spreads cross 900bp is 36.9%, 25.5%, and 20.8%. In fact, with a horizon of a year or more, an investor has never lost money, historically, in 25 examples buying HY bonds as spreads cross 900bp.”

Among stocks, we should expect that different sectors and different geographies may shine at different moments. In general, because all stocks regardless of “quality” have suffered, managers have been upgrading their portfolios to stocks of companies with more durable enterprises. That said, value managers, who have been outperformed by growth managers since the Great Financial Crisis, may finally get their chance to shine later in the recovery as more cyclical businesses rebound.

Early in the decline, emerging market stocks held up better than US stocks, perhaps due to the better success many Asian countries had in containing the virus. However, as dollar liquidity became tight, EM stocks and developed market foreign stocks sold off to end the quarter down somewhat more than US stocks. With a few more days of trading to the date of this letter and the Fed providing massive amounts of dollar liquidity, including opening swap lines with foreign central banks, foreign stocks are performing on par with their US counterparts. That’s remarkable given that US stocks normally benefit from the “flight to quality” pattern in a crisis. This recent performance may bode well for emerging markets and foreign stocks in general as we move forward.

Finally, as we work on financial planning matters with you, we will look to adjust a few elements in portfolios that previously might have been prohibited due to taxation of gains. This will also be a year for harvesting tax losses, although the run-up in stocks to February means there are fewer losses than might be imagined. And we’ll be working on taxation matters that have been affected (mostly positively) by changes that are part of the fiscal stimulus recently adopted by the federal government.

In the meantime, we will continue to reach out to check on how you are faring and encourage you to contact us with any area of question or concern.

Kindest regards,

Frederic T. Kutscher

Scott D. Benner

Cameron J. Barsness

Ryan V. Stevens