President Lincoln began his second inaugural address with an enormous caveat:

“The progress of our arms, upon which all else chiefly depends, is as well known to the public as to myself; and it is, I trust, reasonably satisfactory and encouraging to all. With high hope for the future, no prediction in regard to it is ventured.”

Although confident of ultimate victory on the basis of the North’s overwhelming resources, Lincoln had been surprised and frustrated so often at Union Army mistakes and the persistence of the struggle that he refused to predict when it would end. Instead, he used the address to describe the human cost of conflict as the nation’s punishment for slavery and made a profoundly moving appeal for national healing. The text is well worth rereading in light of the nation’s renewed quest for racial justice.

At this juncture in financial markets, we might say that “all else chiefly depends” upon the path in the war against COVID-19. To say that the US response to the virus has been rocky and inconsistent is a tremendous understatement. Much ink has been spilled about that topic and we can’t add anything meaningful to the discussion. Presently, our progress turns on the reliable production of antibodies and T-cells in our bodies, the quest for an effective vaccine among over 100 in development and evolving social distancing policies and our compliance with the same. One way or another, immunity will come in sufficient (and hopefully controlled) spread of the disease or earlier through widespread inoculation.

As of this writing, the Oxford-AstraZeneca vaccine effort is the most advanced, having been shown to produce antibodies and T-cells in a trial with 1,000 adults. The parties are reported to contemplate having one billion doses available by year’s end. On the other hand, it’s reported in the press that another study showed antibodies from infected persons began to degrade within a few weeks. We are learning about this disease as we go and there likely will be several more twists and turns to the science and policy responses as we move forward. We should be skeptical about changing our judgements based on the latest press stories.

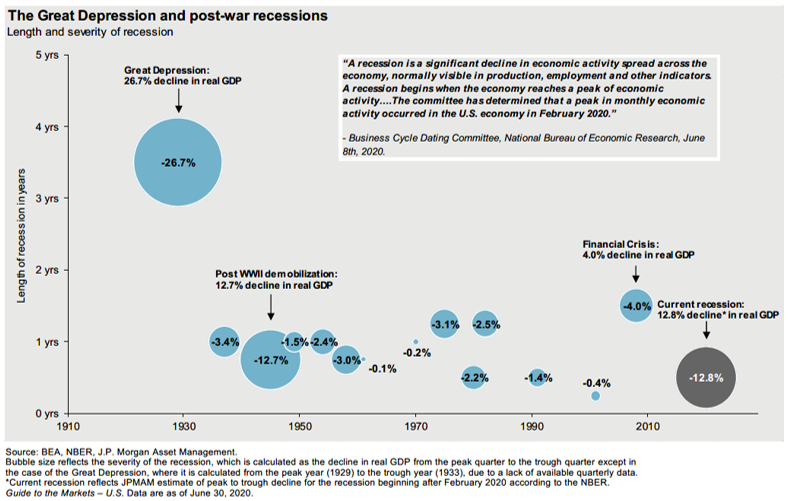

The shutdown of the economy and subsequent partial reopening as a policy response to the virus has created a wave of unemployment and economic contraction unlike anything the country has seen since the demobilization of troops at the closure of WWII. This scale is illustrated in the chart below, which shows how the greater size and speed of the current recession compared to the Financial Crisis, a period that seemed searing at the time.

Stock prices swooned in response to the shutdown, falling about 34% in little over a month and bottoming near the end of March, about the time of the peak rate of new virus cases. By comparison, the Financial Crisis involved a decline of 57% and lasted 17 months as the fallout from the housing decline reverberated through the economy.

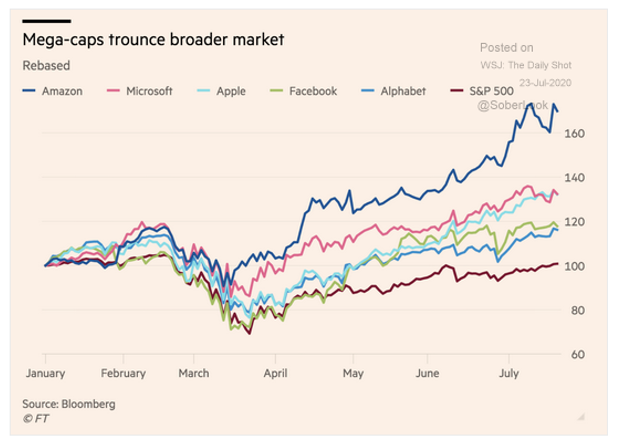

With like pace, following the announcement of massive monetary and fiscal stimulus, financial markets in the US rallied, with US stocks climbing 20% in the second quarter to come in just 3% below the year start. This was the fastest ‘bear market” fall (defined by at least 20%) and “bull market” recovery (a 20% gain) in stock prices that the US has ever seen, and it has occurred thus far without the typical second retreat in stock prices to near the lows of the big decline. The pace of advance was most fierce for mega-cap technology growth stocks (as illustrated below) that appear to have business models that allow their labor forces to work remotely and product demand that seems insulated or enhanced by “working from home” and “social distancing” trends.

Why did stock prices bounce so hard and not look back (yet)? Several explanations are offered:

- The scale of Federal Reserve support for financial markets and federal fiscal stimulus in response to the COVID crisis is enormous relative to what was done in the Financial Crisis. Thus, there’s just that much more money available to purchase assets and keep consumers spending at close to prior levels. For example, many unemployed workers saw an increase in their overall income while on unemployment due to the extra $600 per week provided by federal stimulus.

- Investors remember the last big swoon in stocks during the Financial Crisis and bought this time (or just held on) for the long term, willing to look past the canyon of diminished corporate earnings over the next few quarters or more (more on that below). Given the poor yield on US Treasuries and high-quality corporate bonds (about 1-2%), they think “there is no alternative” (TINA) to owning (mostly) stocks.

- Cooped up at home without sports and other distractions, the public has dramatically increased stock purchases as represented by the enormous increase in accounts opened at discount brokers since the economic shutdown. Signs of speculative excess are seen in Tesla (worth more than the rest of either the US or European automakers combined) and the meteoric rise and fall of bankrupt companies like Hertz (betting on a “rebound” from broke isn’t a good strategy).

Despite the sensible approach to take a long view, we wonder whether the depth of economic damage has truly reached its nadir and, if not, we expect investors will express disappointment if the economy stagnates for a time as opposed to bouncing back. Even now, the relapse in infection rates and renewed restrictions on places of public accommodation during July have been accompanied by a downturn in consumer sentiment and stubbornly high new claims for unemployment insurance (still running at more than 2x the worst rate of the Financial Crisis). Many schools will teach remotely this fall, pressuring the work hours of parents. When improvement in earnings is pushed out two or more quarters, how will investors react?

We also believe policy responses to the crisis may accelerate trends adverse to corporate earnings. With the White House and Senate increasingly likely to come into Democratic Party hands, the chance of increased corporate taxes has risen substantially. Likewise, we wonder whether supplemental unemployment insurance has set the table for some type of income guarantee for workers or other policy that may push up labor costs. As you know from past newsletters, the health of corporate profit margins is a large driver of stock prices and companies have enjoyed many recent years of high margins by historic measures.

Meanwhile, we take stock of some important developments overseas:

- Earlier in July, the leaders of the European Union worked out an agreement to issue collective bonds—something they have never done before—and provide grants to weaker member states (Italy, Spain and others). This could be the start of a fiscal union that has long been missing as a companion to their shared currency, the Euro. Europe has also managed to reopen nearly all of its economy without a substantial flare-up in COVID cases. With European stocks priced more reasonably than US stocks, the relative attractiveness of European companies is improving.

- Conflict with and potential isolation of China is gathering pace. India banned 50 top phone apps by Chinese companies as reprisal for a border invasion by the Chinese. In the wake of a new security law for Hong Kong and allegations of Chinese cybertheft of vaccine technology, the British government banned Huawei components from Britain’s 5G wireless rollout. The US continues to tighten technology controls on exports to China and the two governments are now closing consulates and have put their “phase one” trade agreement on ice. NYSE-listed Chinese companies are preparing to give up their listing to avoid US audit requirements by obtaining listings in Hong Kong and the Chinese mainland. All of this is unfolding while Chinese economic growth is coming in higher than expected.

Like all of you, we have adapted to present circumstances and continue our work for clients remote from our office. That is going well and we are grateful for your attention and trust as we’ve migrated to video meetings and sent recommendations more frequently in response to changes in asset prices and to increase the “quality” element (or durability) of stocks in portfolios. We also have an eye out for an economic bottoming that may signal the start of a better environment for managers focused on value and cyclical stocks. We will continue to recommend alternative fixed income where that makes sense with a client in order to seek returns close to stocks without the full risk of company profitability. And beyond investment matters, most of our time continues to be on the financial planning work that is aimed toward keeping clients secure by living in balance with their assets. We’ll continue to be in touch on that and encourage you to do the same.

Kindest regards,

Frederic T. Kutscher

Scott D. Benner

Cameron J. Barsness

Ryan V. Stevens