The first quarter of 2022 was a uniquely challenging one for financial markets and investors, as both stocks and bonds generally declined. As a consequence, the boost, or at least store of value, from bonds that normally accompanies a stock decline didn’t happen, causing a mixed stock and bond portfolio to exhibit results much closer to the results for an all-stock portfolio than normal.

The quarter opened with financial markets anticipating the start of interest rate hikes by the Federal Reserve in March. In late February Russia invaded Ukraine, setting off a series of supply disruptions, some as a direct result of the conflict (e.g., shuttered auto parts factories in Ukraine) or as a policy response by Western nations to isolate Russia (e.g., embargoes of various goods). The effect on stocks in Europe and certain emerging markets was especially pronounced, as these countries are more vulnerable to commodity prices than the United States. Thus, for globally-diversified investors the quarter was more difficult than for those invested only in the United States.

As is evident from the figures in the chart at right, a mix of stocks and bonds did not help dampen declines in the first quarter. In fact, US bonds as measured by the most common index fell farther than US large-cap stocks. Thankfully, periods like these—where bonds fall more than stocks—are quite rare.

This period of poor performance was amplified by a dramatic move upward in bond yields during the quarter. As an illustration, the yield on the 10-year note moved from 1.52% at the end of 2021 to 2.32% by March 31 and about 2.9% as of this writing, an enormous adjustment in three months. For reference, the yield on the 10-year note rose about 1.65% over a two-year period during the last hiking cycle (from 2016 to 2018). Thus, long-term bond yields have already accomplished a fair amount of normalization, even as rate hikes have barely started.

The Current Rate-Hiking Cycle. The attention given to the start of this Fed rate hiking cycle is more pronounced than normal given high inflation readings (8.5% in March 2022) not seen since the 1980s. The March 2022 hike marked the end of the monumental monetary stimulus implemented in March 2020 as a response to the Covid pandemic. That stimulus was a repeat of the “zero interest rate policy” (ZIRP) first instituted following the Global Financial Crisis of 2008-09 and this time was accompanied by even larger purchases of Treasury and mortgage bonds. (In March 2020 the Fed also implemented a series of more technical market support measures that effectively had the Fed supporting corporate bond markets in a way it never had before. Those measures were highly successful in stabilizing debt markets, and are not material to this discussion, but remain of interest as a potential marker of Fed willingness to intervene in future crises.)

The Fed slow-walked the withdrawal of ZIRP on the belief that the inflation that first showed in early 2021 would be “transitory” as supply chains healed of Covid-related disruptions and consumers resumed their prior patterns of spending on services (i.e., with hospitality locations closed during the height of the pandemic, consumers spent disproportionately on goods, putting pressure on supply and prices). Spending on goods was further enabled by federal stimulus checks of $1,200 sent to most Americans in Spring 2021. Consequently, the Fed has the job of not only withdrawing its monetary stimulus, but cooling an economy goosed by monumental government fiscal stimulus. And, by its own admission, the Fed is late in doing so, thus creating concern in financial markets that the Fed may raise rates so high or fast as to cause an economic recession.

The Historical Record on Rate Hikes. To understand the level of concern around the start of the rate hiking cycle, let’s recall how stocks and bonds react to changes in the general level of interest rates. For most bonds, rising rates diminish bond values for the simple reason that existing bonds with fixed rates of interest (“coupons”) are less attractive than new bonds that pay higher interest. The downward effect is reduced for bonds with shorter maturities, which is why we have favored funds that invest mostly in shorter maturities, nearly all of which beat the major bond benchmark in the quarter ended March 31.

Bonds that pay interest that varies with a benchmark rate (an “adjustable-rate mortgage” is an example) can typically hold their value during a period of rising rates or even see increases in value as investors adjust their portfolios to add such bonds. This is a reason why, in anticipating this rate hiking cycle, we have recommended investing in floating rate senior secured corporate loans through publicly-traded closed-end funds, or through private funds for those investors who are willing to undertake the volatility and illiquidity of those types of fund structures. On the other hand, such bonds can suffer when the economy weakens and fears of corporate defaults mount. Thus, bond portfolios need to continue to hold significant portions of “core bonds” as a reserve for economic slowdowns.

The reaction of stock prices to rate hikes is more complex. Rate hikes normally begin when economic growth is robust and even accelerating, which typically bodes well for corporate earnings, so stocks often advance during the early portion of rate hiking cycles. However, the Fed sometimes keeps hiking even after growth begins to slow, perhaps to bring inflation closer to its target. When growth is slowing, the increase in earnings may not be enough to offset the effect of greater corporate borrowing costs and the increased relative attractiveness of bonds versus stocks. Later in an economic cycle, companies may also have to pay more for labor as it becomes increasingly difficult to fill open positions.

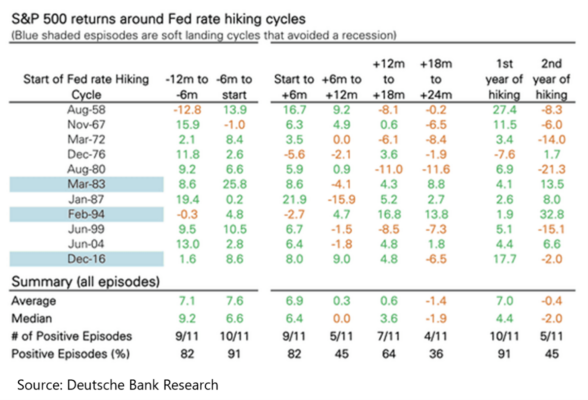

The history of rate hikes is that, more often than not, they result in recessions, and recessions bring general declines in corporate earnings and stock prices. In a few instances, the Fed has engineered a “soft landing,” which means a cessation of rate hikes that cooled inflation without causing a recession. The financial press is much in debate about whether the Fed can engineer a soft landing this time, and if it can’t, when a recession might occur.

As unsettling as it may seem to contemplate the consequences of rates hikes, it is worth looking at the historical record, which is nowhere near catastrophic for stock prices as shown in the table below.

The Three D’s and Longer-Term Trends. Practically since the onset of the Covid pandemic, we’ve been discussing the extent to which changes in consumer patterns, employment practices, social engagement and other matters would persist beyond the public health emergency. Our purpose has been to reflect on the society we are becoming and the consequences for the economy and capital markets. This is a big topic that could consume several pages, but here we want to just remark that the war in Ukraine and the isolation of Russia, coming as concern about Covid wanes, appear to bring a marked additional trend to those that have been in the public mind, e.g., work from home, reduced business travel, among others. Thus, this topic merits some discussion now.

The economic shunning of Russia by Western countries and multi-national firms is a profound example of how trade flows, investment, general commerce and even foreign currency reserves can be upset by a coalescing of public condemnation coming from many different parts of society at once at a scale and speed we have never seen before. Progressive public activism has been a feature of Western nations for a long time, but the swift and contemporaneous action by governments, citizens and corporations in response to Russia’s invasion is new. It raises the possibility of further such action that may surprise us, including the possible attempt to isolate China should it seek to take control of Taiwan. Given the scale of China’s integration in the global economy, that would have seemed unthinkable before; now it is clearly “thinkable” but remains unbelievably daunting.

To recite a convenient encapsulation, the global economy could be said to be dominated by three themes since at least the early 1990s when the Cold War ended: digitization, demography and development. Digitization of course refers to the application of computer technology to drive efficiency in the delivery of products and services, not to mention entire electronic product categories. Global demography has been characterized by growing global labor forces and is inextricably linked to development.  The growth of world trade and internationalization of supply chains has drawn billions of people into the global labor force, a trend complemented by fertility rates in many of the non-G7 countries that were generally high enough to result in population growth.

The growth of world trade and internationalization of supply chains has drawn billions of people into the global labor force, a trend complemented by fertility rates in many of the non-G7 countries that were generally high enough to result in population growth.

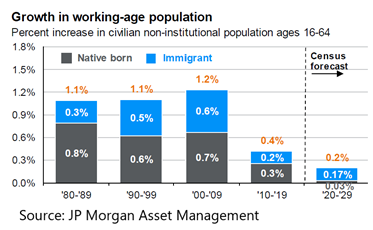

Innovation will continue and likely will be more broad-based around the globe given the ever-wider availability of powerful computing. But demography (see chart at right of US population growth) is becoming less favorable and development is certainly changing, both due to the development of emerging economies that has already occurred and to the likely “near-shoring” or shifting between countries of corporate supply chains, for more general resilience and as a response to heightened geopolitical risk.

We will come back to this topic in the future, but for now we make the following remarks:

- Despite the recent downward pressure on growth stocks, investing in today’s and tomorrow’s growth enterprises remains imperative, and we expect the geographic distribution of growth companies to continue to widen.

- Supply chain adjustments (including the relative availability of commodities) will have varied effects in the emerging markets, making active management even more important to navigate that terrain. The stock markets of the developing world continue to reflect a pricing discount near historic lows compared to the US despite contributing an increasing number of globally dominant firms (with Taiwan Semiconductor and Samsung Electronics to name just two such firms absolutely critical to global supply chains).

- Smaller labor forces in the US and the developed world point toward higher labor costs, which are adverse to corporate profits and stock prices. High corporate profit margins since at least the Global Financial Crisis, in part due to past low wage increases, and the tendency of margins and wages to revert over long cycles, is something that we have written about for several years. Thus far, margins have largely been maintained through price increases, but the durability of that trend will probably break down, at least for some companies. This dynamic augurs for focusing on quality companies with franchises that are critical to the economy and thus have durable pricing power.

For all these reasons, we see the landscape of investment leadership shifting and reordering as the global economic efficiencies brought on by globalization are partially eroded (and new opportunities created) by the frictional costs of geopolitical conflict, trade restructuring and demographic change. With an eye to the spectrum of outcomes that may evolve from this changed environment, we counsel clients to continue investing through a geographically-diversified combination of actively-managed and passive strategies, augmented by private strategies as possible and prudent, while maintaining ample reserves in cash and core bonds.

We’re grateful for your trust and confidence in our work for you and wish you a bright and vibrant spring.

IMPORTANT DISCLOSURE INFORMATION

You should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from KBBS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing. KBBS is neither a law firm nor a certified public accounting firm.