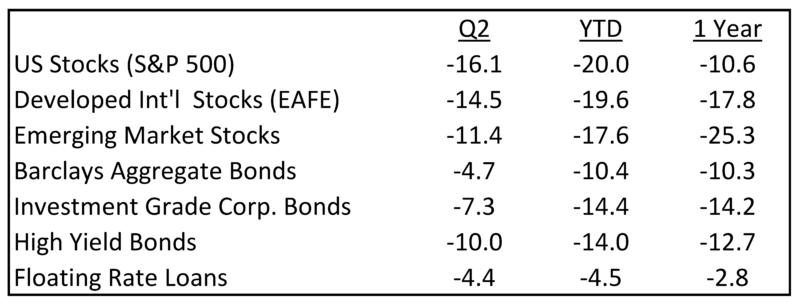

We’ve all seen action movies where the hero-protagonist seems to suffer one setback after another in the opening half, to the point where you’re left thinking “What else can go wrong? How is the hero ever going to get out of this?” The front half of 2022 in financial markets has felt a bit that way. The second quarter was a continuation of the declines of the first quarter as the Federal Reserve continued its rate hikes in the face of rising inflation (measuring 9.1% on the Consumer Price Index in June). Both inflation and the pace of hiking are at levels not seen since the 1980s.

And, unfortunately, we don’t have neat tricks for this predicament like the tiny saw on James Bond’s watch, ideal for cutting free when captured. On the other hand, the action film writer has to come up with a means for the hero to prevail, else all will be lost. Investors, by contrast, just need to keep watching and eventually the productive force of owning businesses and lending capital brings positive returns.

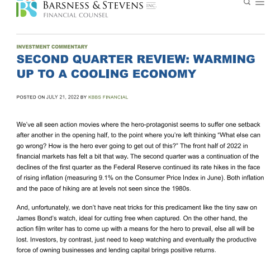

To comment further on the past quarter: Foreign stocks outperformed the US, despite the dollar advancing. Bonds didn’t fare nearly as badly as stocks, an improvement and reversion closer to normal behavior after an especially bruising first quarter when they fell as hard or harder than stocks. Investment grade and high yield bonds have suffered more than the broad indexes this year, especially in the last quarter, which is something we expected would eventually occur in the present hiking cycle when we reduced corporate bond exposure last year and favored floating rate loans where appropriate. And because stocks and bonds can be seen in the chart to have had similar declines over one year, client stock-bond investment policies are generally not out of balance, so our investment work stays focused on normal reallocations, as opposed to one “big trade.”

The better performance for bonds during the quarter reflected that interest rates for US government bonds have fallen back from their peaks as concern for a recession (and speculation about the timing for a future Fed rate cut) has slightly overtaken concerns about current rate hikes in response to inflation, although we caution that higher readings of inflation could push rates back to the central concern, which would be bad for both stocks and bonds.

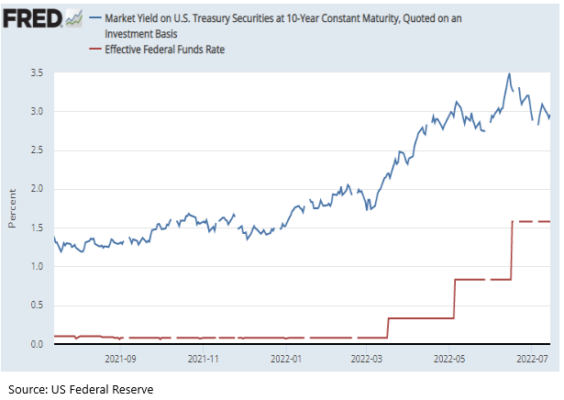

We’ll mention a few related factors of cooling economic activity because they bear on the likelihood of recession and the related chance that the Fed may ultimately not hike rates as far as they project, something that would help lift stock and bond prices. For example, while inflation is obviously high, prices of several key commodities (including crude oil) are down significantly from their peaks in the last couple of months, supply bottlenecks have eased somewhat, and expectations of future inflation have come down as shown in the chart at right. Business surveys called “purchasing manager indexes” are getting close to contraction mode for manufacturers. And some readings on employment are getting weaker, including rising new claims for unemployment, business layoffs and the household employment survey (as opposed to the “establishment” survey of jobs created; e.g. 372,000 in June).

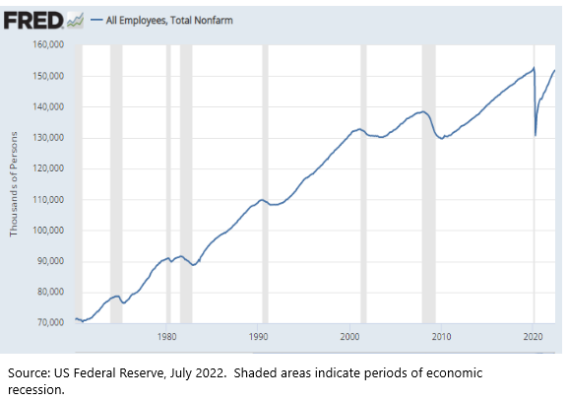

One might easily question, as repeated frequently in the press, how can the economy enter a recession while so many jobs seem to be created each month? To make sense of this conundrum, it helps to look at the pace of employment over several decades. Below you can see that total jobs dipped with each past recession and then rose back to the prior level and beyond before dipping again with the onset of the next recession.

Total jobs are not yet back to the prior peak, even as several factors are pushing the economy toward a possible (we would say probable) recession: Fed rate hikes; absence of new fiscal stimulus; commodity price spikes. So, rather than look at the chart and conclude “we can’t have a recession because jobs haven’t exceeded their past level,” we think it’s more reasonable to conclude that businesses are not as well staffed as they have been at this point in the business cycle in the past, so with the coming recession we should not expect the scale of employment reductions seen in past recessions. A related point of optimism is that the better job market and leftover stimulus evident in consumer bank balances should tend to dampen the severity of a recession if and when one comes in the current rate hiking cycle.

Indeed, while the onset of a recession might bring somewhat further declines in stock prices prior to the start of a new advance, we remark that the current posture of stock market prices is rather favorable. The June 30th quarter-end price-earnings ratio of 16 on the S&P 500 Stock Index is associated with generally favorable total returns over the following 5-year periods, even if, as we expect, earnings are downgraded near term.

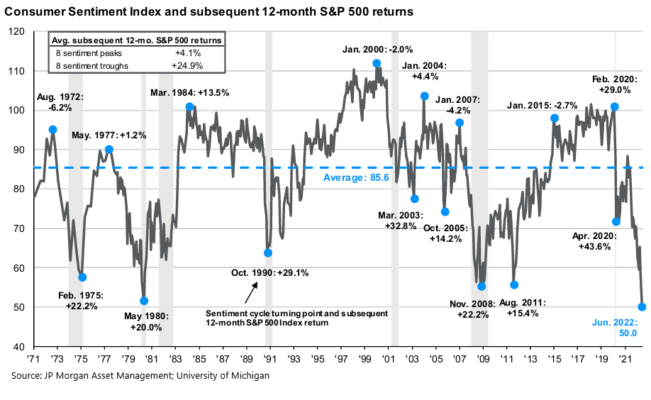

Next, we offer the following chart showing the University of Michigan Survey of Consumers going back to 1971. You may be aware that current readings on the index are extremely low as shown below. Shaded areas of the chart are periods of economic recession. The 12-month stock price return for the S&P 500 is noted at each apex and nadir identified in blue. The chart illustrates that (1) sentiment bottoms tend to occur around (often before) recessions; and (2) due to the lower stock prices that accompany recessions, subsequent 12-month returns following low readings on the sentiment index tend to be very favorable. And while recessions are only officially identified in retrospect (usually several months after the fact), the Michigan sentiment reading occurs monthly, potentially helping investors identify points of concern and opportunity in stock prices.

On the matter of identifying recessions, we caution that later this month there may be some controversy in the press as to whether the economy is in recession or not. GDP was negative in the first quarter (although that was a bit of a fluke due to inventories and exports and imports). Some current estimates for second quarter GDP were also negative. The official advance reading on GDP from the government will come at the end of July. Two quarters of economic contraction are often mentioned as the definition of recession, although that is not the official definition used by the National Bureau of Economic Research, which rules the existence of a recession by a committee of economists looking for a widespread reduction in economic activity. Rather than debating such status, we think it is more useful for clients to reflect that the economy is certainly cooling, stocks and bonds are priced more attractively than 12 months ago and the prospects for investment returns going forward have improved.

We hope this letter has been helpful and look forward to picking up these topics when we speak next time.

__

Download PDF

IMPORTANT DISCLOSURE INFORMATION

You should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from KBBS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing. KBBS is neither a law firm nor a certified public accounting firm.