All families, and many of us individually, have memories of what things cost in the past as evidence of inflation. When your author’s parents were married in Billings, Montana in 1963, they had $110 between them and needed $107 the following week to pay tuition for my father at the local community college. They marked the end of their weekend honeymoon in Red Lodge with burgers and fries at a drive-in on their way home. The bill was $2.75. Off and on, my parents have repeated that meal on their anniversary. Now residents of Florida, this year’s celebration at a Bob Evans restaurant near their home cost $29. The increased cost annualized over the intervening 58 years works out to 4.1%, an imperfect measure to be sure, but not far off the Consumer Price Index (“CPI”) official measure of 3.8%.

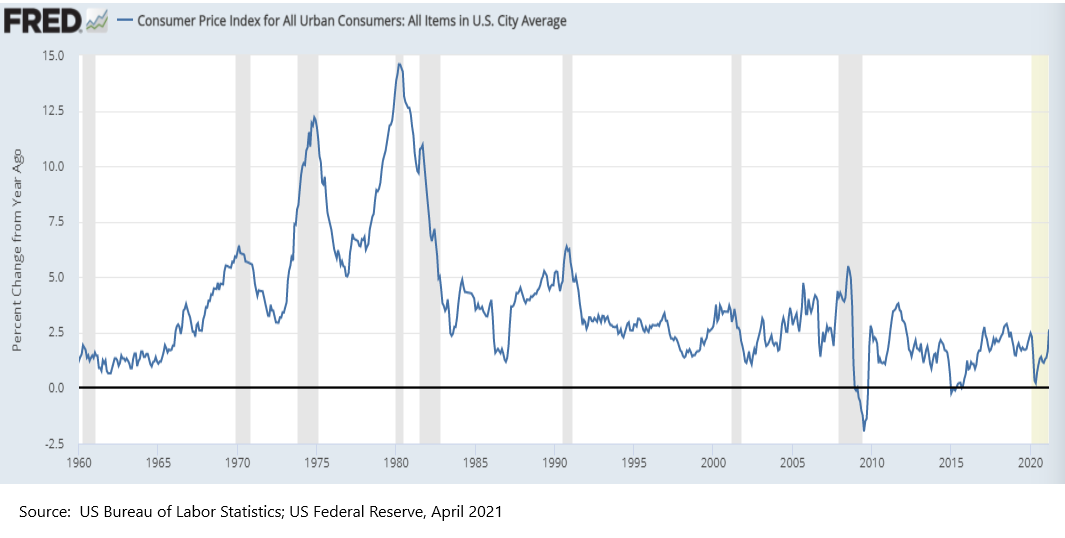

Stories like these may be on people’s minds as we read and hear public concern about whether increased government spending in combination with low interest rates will “bring back” or “cause” inflation. As the anecdote above illustrates, inflation is a persistent feature of economic life, and in small doses, as explained later in this letter, is actually welcome. The present concern is really about whether we are going to return to inflation of the sort from the late 1960s to early 1980s as shown below.

Inflation in small doses, such as the Federal Reserve’s 2% target, is a hedge against deflation, which is a consistent fall in prices. Economic activity slows with deflation because people and firms stop or delay their purchases, anticipating that whatever is desired will be cheaper in the future if they just wait. Firms lose business and lay off employees, and borrowers find it increasingly difficult to pay their debts, leading to the kind of severe economic distress that central bankers seek to avoid above all else.

Modest inflation also has a psychological benefit for workers by contributing to pay increases that give a feeling of improvement, even if real wages aren’t rising much or at all. Likewise, someone may sell their home or a stock that they’ve held for a long time and feel pride at the appreciation they have received without recognizing the extent to which inflation has contributed to that rise. Actually, for most of us, living in a world where prices are consistent from year to year and decade to decade would be utterly foreign and potentially unnerving.

Inflation, 1965-1982. By contrast, when inflation is significant, the feeling that prices are rising creates anxiety in the public that wages won’t keep pace, assets are depleting, and retirement is unattainable. By the mid-1970s, this concern was so severe that President Ford ran for re-election on his “WIN” slogan of “Whip Inflation Now.” But inflation would not be whipped until cigar-toting “Tall Paul” Volker (6’ 7”) took the helm of the Fed in 1979 and led it on a march to higher interest rates. Under Volker, the federal funds rate started at 11% and reached 20% by mid-1981, a blistering pace that caused a severe recession. Unemployment hit 10%. Banks charged 21.5% interest to their prime borrowers. New capital formation came to a halt as firms found it impossible to generate earnings sufficient to support new borrowing.

To those who lived through it, it was a searing experience. Your author’s family’s research business, which depended on real estate development, contracted 75%, putting the family’s future in real peril. At home, Volker’s name was mentioned with both anger and grudging respect for leading an awful task that had to be done. That perspective was generous compared to much of the abuse heaped on Volker by a public reeling from recession and politicians giving voice to their pain. It is difficult to imagine any public leader today having the stature to withstand that kind of pressure.

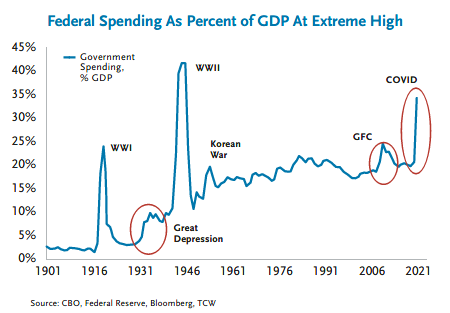

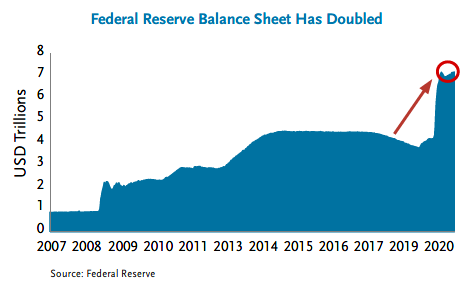

Cause for Present Inflation Concern. So, given that awful history, it is understandable that we should wish to avoid repeating it. The cause for concern is the scale of debt-financed stimulus pursued by the federal government in combination with a return to a “zero interest rate policy” (ZIRP) and enormous debt purchases by the Fed. And the scale of what we’re doing is truly remarkable as shown below.When the “in person” economy (e.g. hospitality, most retail, much of manufacturing) was shuttered in Spring 2020 to control the spread of Covid, the federal government acted with haste to support worker paychecks with enhanced unemployment insurance, businesses with forgivable loans and so on. The Federal Reserve stepped into frozen credit markets by radically expanding the list of firms that could borrow from it and the assets that could serve as collateral for loans. Simultaneously, the Fed employed ZIRP and reinstituted purchases of US Treasuries and mortgages, like following the Global Financial Crisis, although this time at a much bigger scale.

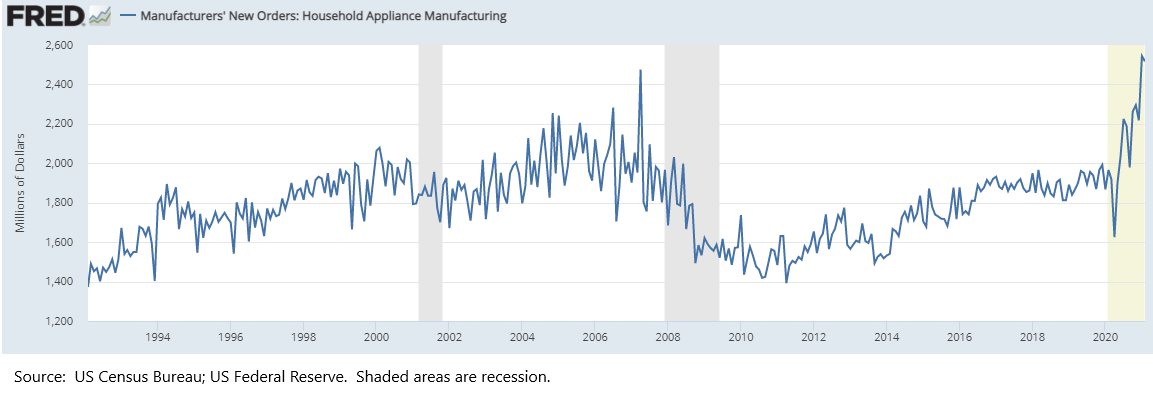

The combined fiscal and monetary action were a success as financial markets stabilized and consumer incomes (measured broadly)remained whole. Much of the services workforce was able to work remotely andmanufacturers quickly reopened with measures to control the spread of Covid. In fact, with people spending much more time at home and competing for space with spouses and children, home remodeling, new construction and durable goods purchases boomed. To anyone who doubts thiseffect, consider for example the Federal Reserve data set on appliance purchases as shown below. Notice the meteoric rise at the right end of what is otherwise a humdrum chart.

Such strong demand in an economy whose production of goods was constrained by health regulations to control the spread of Covid has already caused episodic increases in prices and exposed production bottlenecks. The news is replete with shortages and delays in the production of semiconductors, the building blocks for electronic components in durable goods. Just measuring prices in the next few months against the economic nadir from last year’s shutdown will bring CPI to 2.5-3.5% by May. Be prepared for lots more news about inflation!

The Continuing Case for Inflation Skepticism. Even so, it is very much an open question whether the pressure of the stimulus in combination with an economy that was already growing strongly as it reopened will create enough sustained pricing pressure to change consumer and worker expectations of inflation. As explained further below, the outcome can’t be known until it comes to pass, and thus we do not recommend any change to client portfolio allocations that are already composed to tilt against rising yields (an accompaniment to inflation). As Howard Marks, one of our favorite thinkers on investing, reminds us, it is the job of the portfolio allocator not to predict the future but to be prepared for whatever future comes. That work starts with a client’s investment policy mix of stocks, bonds and cash and is further refined by asset allocation by geographic region, value vs. growth, creditworthiness, etc. Within that mix are some assets that will outperform in an era of cyclical reflation and others that will outperform in an era of slow growth like that which has characterized the economy since the Global Financial Crisis.

The case to be skeptical about a sustained acceleration of inflation was recently stated succinctly by economic forecaster and market strategist David Rosenberg in his March 8th column in the (Toronto) Financial Post:

What was remarkable about the last cycle was that even with an apparently tight labour market, a tax-induced surge in the fiscal deficit to a cool trillion dollars, a credit and equity market surge and a nice housing asset growth cycle, it turned out to be the mildest inflation cycle since Leave it to Beaver was dominating our attention on black-and-white television sets in the 1950s. CPI inflation was just 1.8 per cent at an annual rate for that entire 2009-2019 cycle, something we hadn’t seen in seven decades.

Thus, with lots of slack in employment as a consequence of Covid, and reflecting on the experience of the last economic cycle (when there were similar warnings about coming inflation), it is difficult to see how workers would be able to demand faster wage gains that are critical to substantially greater inflation.

Despite sustained inflation seeming unlikely, it is fair to say that risks have increased. There is more political focus on raising wages, both through the minimum wage and increasing the power of labor unions. The deflationary effect of globalization is abating as political pressure to “brings jobs home” grows and China is increasingly viewed as dangerous competitor that should not be our supplier of certain goods. Believing it raised interest rates too soon in the last cycle, the Fed has changed its strategy from hiking rates when it believes its target is imminent to waiting for that target to be sustained. And the scale of fiscal stimulus is so much greater now versus in 2008-09. In particular, if the demand for increased social services we see in the political arena were to become enacted without a general tax increase, such that the budget deficit we have now were to become more or less permanent, one would have to think that eventually the economy would overheat.

First Quarter Market Performance

The first quarter of 2021 saw stocks extend their gains from last year. US stocks were up 6.2% measured by the S&P 500 Index, with essentially all of the gain coming from cyclical “value” stocks that benefit disproportionately from the reopening of the economy. International stock markets produced about half that level of return as the US economy is the furthest along in exiting from the effects of shutdown. Most of our favored stock managers beat their benchmarks during the period.

US bonds, as measured by the broad Barclay’s Aggregate were down 3.2% for the quarter, reflecting an increase in yields in part from a strengthening economy and in part from worries about whether inflation is coming. Our preferred core bond manager, DoubleLine, with a shorter duration leaning against yield increases, was down less than half of the benchmark, and most other managers, focused in various corporate bonds and structured credit that are more correlated with stocks, had small positive returns.

Looking at portfolios at this juncture, we believe clients are reasonably positioned regardless of most economic outcomes. We like our lineup that reflects a tilt toward high-quality US stocks and emerging markets. Both of those areas, and especially EM stocks, have been solid performers when inflation is rising. International stocks are more reasonably priced than US stocks and quality stocks should outperform if the economy cools following this initial period of stimulus.

Having said that, one thing we are examining is reducing the most economically sensitive area of bond allocations. As stocks have risen, those bonds have done well also. Now, we believe the rewards of continued ownership have narrowed sufficiently that we should consider reducing the holding. We will be in touch soon about that adjustment and will appreciate the prompt response clients typically give.

In the meantime, we hope you and your families are well and wish you the best as we collectively navigate through the vaccination process and toward a society and economy that reflect a managed approach to risk of infection.

Kindest regards,

Scott D. Benner

Cameron J. Barsness

Ryan V. Stevens