Our newsletter for the third quarter is a departure from custom as we use the reasoning and analysis for a recommended trade to illustrate what we see happening in financial markets. We will follow under separate cover with a request for trade approval if you own the relevant funds.

Among the many cognitive errors that human beings make is the tendency to categorize items in binary terms without regard to the strength of the relevant characteristic.[1] In the arena of politics, we all know about the tendency to categorize people as “liberal or conservative,” “Democrat or Republican,” labels that many of us try to avoid. When your author started law school at New York University, he was confronted early with the question: “Yankees or Mets?” as if one had to be a fan of one team or the other. My reply of “no opinion” was wholly unsatisfactory to my peer group. (Apart from two years in Cincinnati, where I was a fan of the Big Red Machine, childhood in Portland, Oregon largely denied me the pleasures and obsessions of Major League Baseball.)

This tendency in the way we organize information can cause investors to overlook or overstate elements of risk. Here is an example quite relevant to our trade recommendation: Investment policies are defined in terms of percentages of stocks and bonds (held through mutual funds or ETFs). Stocks are typically thought of as the biggest source of risk in a financial portfolio, while bonds are often thought of as “safe.” But which stocks? And which bonds? How does a small oil company’s 10-year bond compare to the stock of a major electric utility? Might the cash flows of the former be more uncertain than the latter? If so, which one is “riskier?”

This nuance underlying major asset categories is one element we must keep in mind as we monitor client portfolios for potential adjustments. Those adjustments are meant to address changes in our perception of the risk and reward involved in holding different kinds of assets, while also staying true to a client’s investment policy, managing tax exposure and a variety of other considerations.

Here we come to our current recommendation: We believe that the rewards of owning corporate and high-yield bonds have declined (as bond prices have moved up) such that we recommend trimming in that area. For most clients that means selling Loomis Sayles Bond Fund or iShares ESG US Corporate Bond ETF and reinvesting the proceeds in Guggenheim Total Return Bond or TIAA Core Impact Bond Institutional.

Asset Class Summary. To better understand this recommended adjustment, it is worthwhile to quickly review the role of stocks, core bonds (i.e. US Treasuries and mortgages) and corporate bonds in portfolios.

Stocks predominate in client portfolios because that’s where most returns come from over longer periods—returns that investors need. While stock prices are somewhat high, we can’t predict when they might significantly retreat, and we think clients will be rewarded for holding them over the coming 10-plus years that are required of any stock investor.

Core bonds exist in client portfolios as a store of value for when stocks retreat and bonds can be sold to purchase more stocks (something we did when Covid panicked financial markets in March 2020). Before the Global Financial Crisis (GFC), core bonds also offered meaningful returns in the form of yield (i.e. cash interest paid on the bond), but since the GFC, the Fed’s “zero interest rate policy” has largely removed the yield element from core bonds. For example, the yield on a 10-year Treasury note is currently near 1.25%. Mortgage pools offer somewhat better yields and a near guarantee from Uncle Sam (as the GFC proved out).

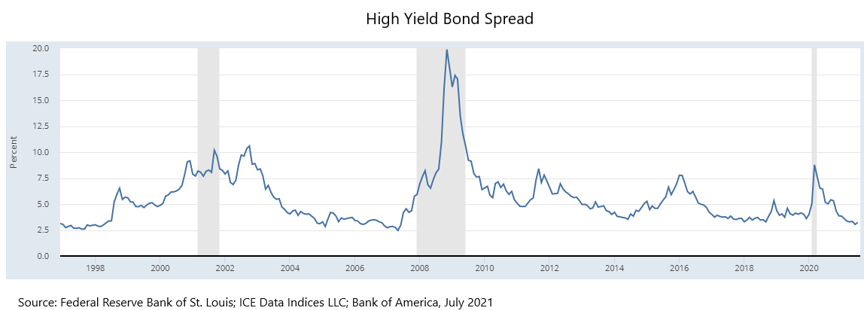

With core bonds offering such low yields, investors have sought better returns in corporate bonds, especially “high-yield” bonds that are rated below investment grade. The extra yield that the holder of a non-Treasury bond makes above the yield on a comparable Treasury bond is called “spread,” which is the compensation the holder receives for bearing the risk that the bond may not be paid in full. As shown in the chart below, this compensation has narrowed to a level near its all-time lows. When a spread of about 2.5% is added to the base Treasury yield of about 1.25%, you can see that investors are being paid less than 4% interest for holding “high-yield” bonds. If that doesn’t sound “high” to you, we agree.

In exchange for that spread, a corporate bondholder must bear risk in value associated with weaknesses in the economy and in particular corporate earnings. Spreads widen (and corporate bond prices fall) during times of market stress. The shaded regions in the chart above are recessions, which are also times when stocks decline. That makes sense because when earnings fall during a recession, not only are the rewards in dividends and buybacks for stockholders reduced, but companies are in a weaker position to repay their bondholders, thereby increasing the risk of holding corporate bonds. In calendar year 2008, the worst year of the GFC, high-yield bonds had negative returns of 26% (corresponding to the peak in yields in the center of the chart above). Of course, the rewards of buying during stress can be handsome: 58% for high-yield bonds in calendar year 2009.

The year 2009 was also a great year for Loomis and represented a comeback from sobering returns the year before. With liberal restrictions on investments in high-yield bonds (35%), foreign bonds (20%), and even stocks (20%), Loomis had been punished by the credit panic nature of the GFC. For clients with us at the time, they will recall that we doubled down on Loomis and added emerging market stocks and real estate investment trusts in December 2008, since those areas all offered even better prospects than beaten-down US stocks.

Recommended Realignment of Corporate and Core Bonds. By contrast, we think the current risk-reward profile of corporate and high-yield bonds is poor. The downside correlation to the stock market that corporate bondholders always bear just isn’t well-compensated at current yields. Recessions (e.g. 2008), broad-based disappointments in corporate earnings (e.g. 2015) and rising interest rates (e.g. 2018) all take their toll on stock prices. While we don’t think the economy is headed for a recession any time soon, economic growth is slowing from the breakneck speed of early 2021 and inflation has surprised to the upside, leading to concern about the timing of Fed interest rate hikes. Thus, this seems like a reasonable juncture to reduce risk.

The recommended exit from Loomis also corresponds with the retirement of Loomis’s long-time leader, Dan Fuss. Fuss not only managed the fund, but also set the culture of the Loomis firm over many decades, which has a reputation for rigorous credit work and savvy market moves. Nonetheless, when the long-time leader of an asset management firm departs, that is a time of heightened risk that the processes which have led to the firm’s success may be disturbed as the firm sorts itself out under new leadership. Consequently, in many, but not all such situations, we have recommended clients reposition investments elsewhere in their portfolios.

iShares ESG US Corporate Bond ETF (ticker SUSC) is an index of US investment-grade bonds that result from an ESG screening of the Barclay’s US Corporate Index. Because of the investment-grade focus, the fund is less volatile than Loomis, but it also offers even thinner yield. We think selling SUSC is worth doing for similar reasons as Loomis, even if the magnitude of risk removed is somewhat less.

Selling Loomis and SUSC can be done without realizing significant capital gains in clients’ taxable accounts, something that can’t generally be done with stock funds, which are up significantly over the past year and more. So, in that sense, the cost of the move is low relative to the benefit of downside protection gained.

In trimming corporate and high-yield bonds, we wanted to diversify client positions in core bonds by utilizing a second firm, rather than adding to DoubleLine Total Return Bond Fund, which is focused in agency residential mortgages. While we are happy with DoubleLine, its mortgage focus means that it is always less sensitive to interest changes than the major bond index. We wanted to add more flexibility on rates and a wider variety of high-quality credit.

Guggenheim is a firm we have followed for several years and, like DoubleLine, is a leader in bond investing. They have a deep bench of analysts with expertise in structured credit and middle-market lending. These are growing areas of the bond market that demand more of managers to understand not just the underlying credits, but how they have been packaged for investors. For those managers with the capability, this gives them an edge in finding better risk-reward tradeoffs. Guggenheim also has a tendency to reduce risk relative to its benchmark if they think the prospect of returns warrant it. In late 2019 they believed that markets were not sufficiently reflecting the potential for weakness in the economy, so reduced risk. That gave them dry powder when the Covid pandemic hit a few months later and rewarded investors as the economy began to recover. While we aren’t attempting to chase that return, we believe Guggenheim’s experience manifests the wisdom of preparing for disappointment when markets seem unduly optimistic.

TIAA-CREF Core Impact Bond fund is an actively managed fixed income mutual fund that invests primarily in investment-grade securities that have been screened on the basis of ESG factors and criteria. We like TIAA’s broader, best-in-breed approach, as well as their investment philosophy, which favors companies that are best actors in their respective industries and that have seen success in managing their ESG risks and opportunities. The fund’s managers use a top-down view to construct a core fixed income portfolio that has desirable characteristics for the current economic environment and bottom-up fundamental analysis when evaluating the quality of those bonds, quality being shorthand for its attention to ESG-related risks. Although the fund tracks most closely the Bloomberg Barclays US Aggregate Bond Index, the fund managers have the flexibility to own securities outside of this index. We prefer that bond managers especially aren’t restricted to the securities that comprise an index because bond managers often find value (i.e., better yields) in securities that are excluded from an index.

We’ll be in contact under separate cover (generally, email) to seek each client’s specific approval for the above-described trade. In the meantime, we are mindful of several developing situations that are animating markets: renewed measures to combat the spread of Covid in light of the fast-moving Delta variant; fast-growing corporate earnings; readings on inflation coming in above expectations; China’s crackdown on technology firms; the infrastructure bill making progress through Congress; and the Federal Reserve finally “talking about talking about” when to reduce asset purchases and raise interest rates.

If there is something you wish to talk about, we’d love to hear from you. In any event, we wish you a pleasant end of summer and remind you to look for our trade request.

Very truly yours,

Scott D. Benner

Cameron J. Barsness

Ryan V. Stevens

[1] Fisher, Matthew & Frank C. Kell, Psychological Science, 2018, pp. 1846-1858. For education and entertainment, we refer you to List of Cognitive Biases, Wikipedia (https://en.wikipedia.org/wiki/List_of_cognitive_biases).