We hope you’ve been outside this summer and fall, and perhaps had the chance to hike, enjoy nature and let free the mind for thought. In the nearby Cascade Mountains, many trailheads start at a creek bed and, as the elevation increases, the path switches back and forth up to a ridge and even beyond. Perhaps you, like us, are tempted to pause at a switchback to catch your breath, take in the view and try to judge the relationship of the valley to the surrounding geography. The view almost always improves as one move higher until such point that the valley is seen as but one downward fold among many crossing a ridge of mountains stretching out in the distance. With this perspective and a little rest, the perceived difficulty of the climb may fade.

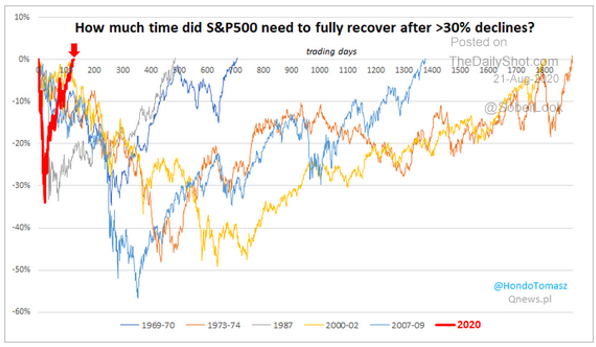

Our experiences with markets and portfolios are similar to a lengthy hike. While we experience the valleys of market lows, our patience may be challenged and we may be anxious or even despondent about how many more zig-zagging price changes it will take before the old high is recovered and we can consider truly passed whatever event brought on the decline—an overheated economy (1970), or Federal Reserve rate hikes (1980; late 2018), or the popping of an asset bubble (2000; 2008) or an exogenous event (1973 oil embargo; 2020 pandemic).

Without declaring an end to the Covid crisis, which would be foolish, we observe that the old February 2020 high in stock prices has been passed and that the recovery occurred at a blistering pace that has essentially no recent historical precedent.

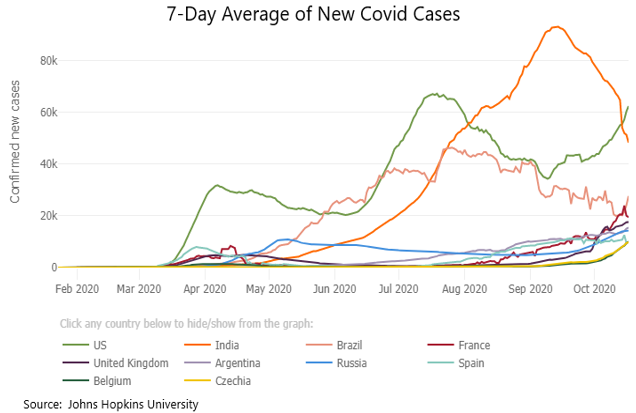

Covid and the Economy. Rates of Covid infections are back on the rise in much of Europe, are finally hitting the Upper Midwest of the United States in earnest and are trending back toward the highs of July for the US as a whole. Notwithstanding the resurgence in new cases, the consequences are less troubling than the spike earlier this year since affected patients are trending younger, treatments are more effective and consequently hospitalizations and deaths have not risen nearly as much as new cases. Governments are trying to be more selective in how they throttle areas of outbreak, rather than implementing broad, indefinite shutdowns. Notably, what we didn’t experience in the recovery of prices was the characteristic “double dip” that one can see in the other path of market recoveries above. That made it difficult to invest additional funds with confidence. This force of recovery can perhaps be explained by the enormous scale of Federal Reserve asset purchases and federal government stimulus spending (both at multiples of what was spent in the Great Financial Crisis) and the knowledge that the initial shutdown would be temporary, although no one knew what the modes and pace of reopening would be.

Enormous resources and speed have been brought to bear in seeking a vaccine to prevent the spread of Covid. The prospects look good for having an effective vaccine, but, perhaps because of the speed or the politics around the Covid response, Americans indicate in polling a low willingness to take an approved vaccine when first available. Consequently, we should anticipate transmission of the disease may remain significant until the population reaches herd immunity through some combination of vaccination and antibodies from exposure.

With retail sales recently strong, even with reduced fiscal stimulus, it appears the economy is capable of self-reinforcing growth, albeit we should expect that growth will remain hampered by large numbers of structurally unemployed persons formerly part of retail and hospitality industries. This has been especially difficult for people of color, who disproportionately work in those industries. Likewise, women have left the labor force in significant numbers as children are schooled remotely from home and traditional gender roles of childrearing take their toll on female workers. Nevertheless, as an analog from recent history, the US economy had to work through a tremendous number of unemployed persons from the building trades following the housing crisis. It did so then and will do so again. The unemployment rate, recently at 7.9% and falling, is already significantly below the 10.0% peak experienced in the last recession.

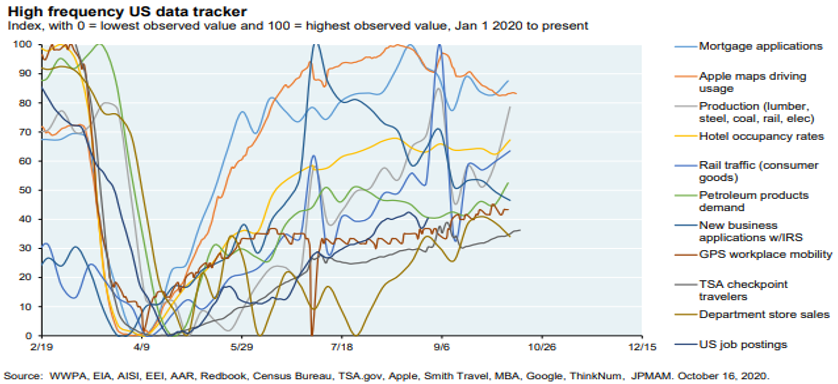

Spending patterns changed radically in response to Covid, as shown in the chart below. Consumers are spending less on travel and dining, while buying more goods for the home.

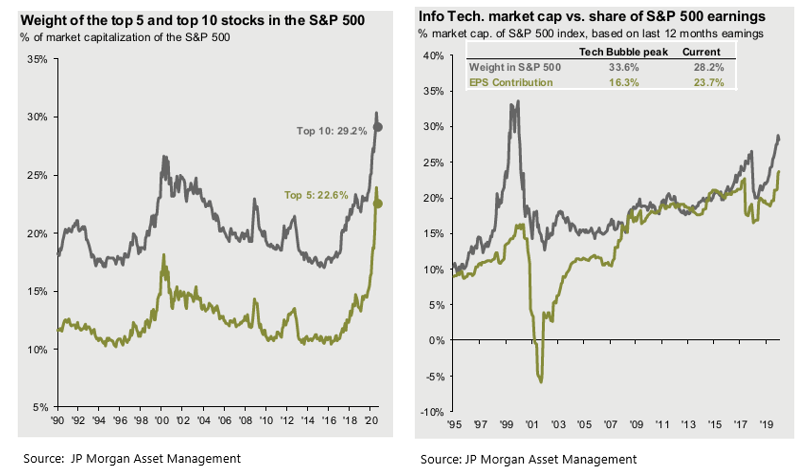

Concentration in Stock Leadership. US stock market performance, as measured by indexes, is usually dominated at any particular time by a small set of companies, but this phenomenon has been more pronounced lately as some companies benefited from the work-from-home trend, while others suffered severely from economic shutdowns. Nonetheless, at least the technology sector seems to be contributing earnings at a level that largely justifies its dominance in index returns.

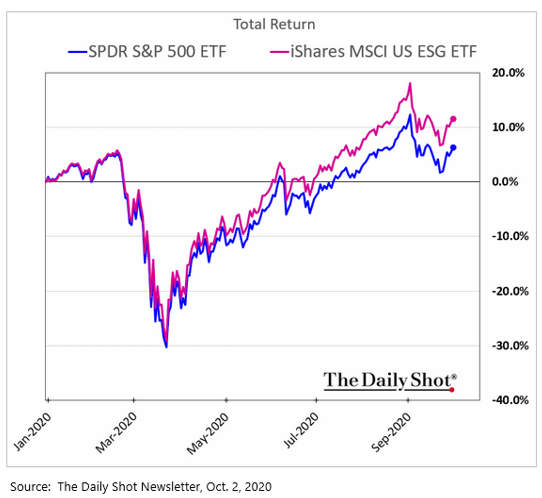

ESG as a Performance Factor. Another phenomenon in the recovery has been that companies who manage environmental, social and governance (ESG) issues better saw their stocks perform better. Historically, the data have shown that ESG as a factor for investment at least doesn’t cost investors return and may help. But in the current market cycle, ESG as a factor has clearly added to performance, perhaps because companies adept at governance and responding to social issues have been better able to manage the disruption in how business is done during a pandemic. It may also be that the longer-term trend of interest in this investing method has gained faster traction as a larger number of people began investing in stocks during the pandemic. Whatever the case, we believe ESG investing can contribute to portfolio performance over the long haul and clients increasingly express their interest in this factor. Our own Cameron Barsness recently spoke at some notable events on this topic and we will share more about them in a separate letter.

Federal Election. The current election cycle, and particularly the presidential election, is on investors’ minds. There are a host of theories, some using data that rival baseball statistics in their esoterica, about presidential election cycles and the stock market. We’ll refrain from repeating any, but we do observe that the stock market has been seemingly faced with a potential binary outcome of higher taxes, greater regulation and potentially more spending with Biden versus current low taxation and regulation with Trump. But, with Biden seemingly comfortably ahead in the polls, and Trump having had recently a particularly bad streak of debate performance, personal tax revelation and his own Covid infection, the market has been remarkably resilient, even sanguine. It appears the increasing possibility of Democratic control of both Congress and the White House has raised the odds of greater stimulus, which the market may favor more than low taxes.

In light of these trends and phenomena, here are the things we’ve been focused on:

- We put energy and resources into buying stocks in mid-March and trimming stocks as the recovery gathered serious pace in the late spring and early summer. As an advisor who needs your approval to make trades, this was a significant undertaking, but by focusing on the big picture of investment policy balance, these trades generated value for clients and reduced risk.

- Our trading has allowed us to make selective quality and ESG improvements in portions of client portfolios, which include adding cost-effective “smart beta” enhanced passive index funds. As noted above, these strategies have done well even during the Trump Administration and may benefit from a Biden Administration.

- We’ve been monitoring the recovery in our preferred managers of non-core bonds (e.g., corporate, high-yield and structured credit), which has kept portfolios from becoming more overweight to stocks than clients might have expected.

- With interest rates so low and expected returns from stocks and traditional bonds likewise low, we continue to recommend alternative and higher-yielding fixed income investments. These include private equity, private debt and selected closed-end bond funds. We are currently exploring opportunities to add yield and growth through infrastructure investments and real estate.

Beyond these portfolio-related efforts, we of course remain focused on helping our clients stay secure and financially fit.

- Whether caused by structural changes in the economy brought on by Covid, a strong market for initial public offerings of stock or other idiosyncratic reasons, we’ve been able to help a number of clients recently unlock value and liquidity in previously private or legacy assets, and think through relocations, home refinancings and job changes.

- We’ve continued to improve our ability to work remotely and made a recent hire in Austin Jodrey, who comes to us with internal operations management experience at a national insurer.

- With our recent subscription to a new portfolio accounting software, and its rollout through 2021, we expect to have improved portfolio reporting and analysis capabilities.

- As the year draws to a close, we’ll be in touch to confirm transactions related to tax-deferred plans, charitable giving and tax loss harvesting.

In this time when many of us are reminded of our blessings—including unique chances to have family close as we shelter from illness—we extend our thanks to you for your friendship and trust in our work for you.

Kindest regards,

Frederic T. Kutscher

Scott D. Benner

Cameron J. Barsness

Ryan V. Stevens