Sometimes less is more. We all know the saying, but seeing it effected in life—through art, sport, business, parenting, gardening—is the exception rather than the rule. Imagination more frequently bends towards complexity.

With that in mind, we endeavor to make this quarterly review more compact and to share some thoughts near the end about simplifying client portfolios. Thankfully, we can get right to sharing some good news about financial markets and portfolios.

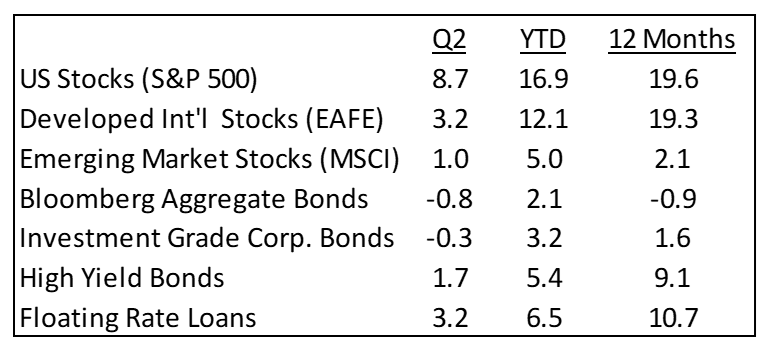

Financial market returns in the second quarter were strong for US stocks and for most of the peripheral bond sectors areas we favor.

Despite the Federal Reserve continuing its rate hiking cycle, the economy continues to perform above expectations, growing 2.4% in the second quarter. Consumer spending remains buttressed by the runoff of savings accumulated from limited spending opportunities and government stimulus during the Covid pandemic. Federal spending authorized by the infrastructure bill, the CHIPS act and the Inflation Reduction Act are providing fiscal stimulus to the economy. Corporate earnings have surprised to the upside in the second quarter after several quarters of modest decline. And the stock market has been ignited by enthusiasm for artificial intelligence, which has driven large gains so far this year in the stock prices of the biggest tech firms, while most stocks have risen much more modestly.

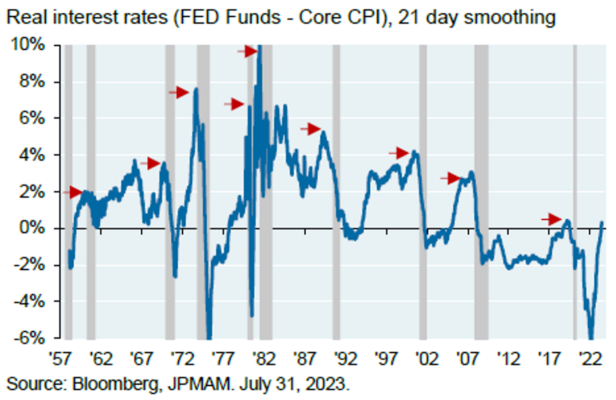

One of the best explanations for the economy’s continued good health is that the Federal Reserve simply hasn’t hiked rates far enough so that financial conditions are sufficiently tight to meaningfully slow the economy. Below is a chart that shows “the real rate” of interest, that being the nominal interest rate (in this case the Federal Funds rate) minus the rate of inflation (as measured by the change in the Consumer Price Index). The shaded areas are recessions. Note that in the several decades shown on the chart, a recession has never started while real interest rates were negative.

So how far does the Fed need to keep hiking rates? That is the big question that hangs over the economy and the stock market. The Fed started hiking rates in Spring 2022 in 0.75% increments, then dropped to 0.50%, then 0.25% and now has skipped a hike in June but hiked again in July.

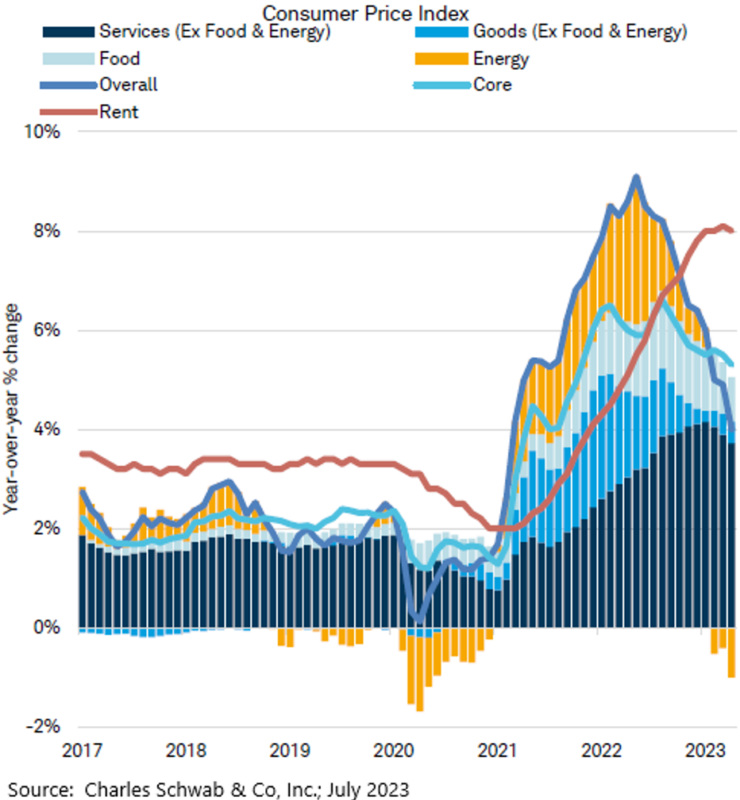

The Fed is trying to bring inflation down to its target of 2%. It has made significant progress in that regard, as shown in the chart below, but still has a considerable distance to go. Thankfully, the Fed is getting some help from events. Supply bottlenecks have mostly worked their way out of the economy. Energy prices have fallen in recent months. But services inflation is sticky.

One factor that will help bring down services inflation is that housing prices and lease rates have cooled. As that change rolls forward in the index data, the housing factor should drop significantly. Still, even if monthly changes in prices for the balance of 2023 were limited to the post 2009 average, official inflation at year end would still be nearly 4% or double the Fed’s target.

With this pressure on the Fed’s inflation-fighting mandate, we were skeptical about market projections earlier in the year for rate cuts prior to year-end. That’s been borne out in Chair Jerome Powell’s recent dismissal of rate cuts before 2024 and now the market is projecting the first rate cut early in the new year. We don’t rule it out but continue to expect later and slower cuts given that real rates are still low. This “higher for longer” rate scenario is gaining traction as the economy continues to perform well. In fact, there is much talk in the market of avoiding a recession (a so-called “no landing”). That remains to be seen (it would be an exception to the norm with rate hiking cycles), but it is certainly the case that weakness is taking much longer to develop than originally thought.

And it is important to note that the Fed response to an ordinary recession will not be to return to the “zero interest rate policy” (ZIRP) it employed following the Global Financial Crisis (GFC) and the Covid pandemic that did so much to increase asset prices. That judgment cannot be emphasized enough and is the basis of Howard Marks’ December 2022 letter “Sea Change” where Marks emphasized that the investment landscape had changed markedly from the post-GFC period. (Marks is co-founder of Oaktree (one of our preferred managers) and notable writer about financial markets.)

To fully grasp this point, it’s useful to recall a little history. The GFC and Covid pandemic were searing events that, respectively, represented a deflationary credit collapse and closed down much of the global economy. The Fed took extraordinary measures in dropping rates and buying bonds to combat the economic damage. The Fed initially believed ZIRP would return the economy to its baseline growth rate and moribund inflation to the Fed’s 2% target, but the economy continued to grow at a sub-par pace for more than a decade as consumers worked off excessive debt and inflation never sustainably rose to the target until just before Covid hit. (Looking back now, with the current experience of high inflation, that policymakers tried to raise inflation may seem like an anachronism. But central bankers fear deflation even more than inflation.)

When the Fed tried to withdraw its stimulus in 2013, markets revolted in a “taper tantrum” and the Fed had to back off its plans. When in 2018 it finally made a meaningful increase in interest rates, stocks fell 20%, forcing Chair Powell to famously “pivot” from promising more rate hikes that December to promising patience before more hikes soon after New Year’s. In addition to fostering instability through lofty financial asset values, ZIRP contributed mightily to high housing prices and general wealth inequality. With these side effects now evident and from the Fed’s behavior and statements it seems apparent that the Fed would be reluctant to return to ZIRP except in the most extraordinary circumstances.

Consequently, the prevalence of attractive fixed income opportunities seems durable, and we counsel clients to consider them. As mentioned by Marks, that means investors can obtain high single digit returns or better (i.e., near long-run returns on stocks) in fixed income investments. Some of the best opportunities are through senior secured corporate loans and structured credit vehicles and using top management to sort through the best credits is critical. These investments typically involve somewhat higher fees than normal bond mutual funds. Thus, to return to our “less is more” theme, we will be instituting trims of certain active stock funds (where fees are significantly higher than available in passive index funds) in order to economize on our fee budget, simplify portfolio management and concentrate more on our greatest conviction investments. We will be instituting these adjustments as we rebalance portfolios and look for thoughtful ways of minimizing realized gain as we do so.

In the meantime, we wish every opportunity to enjoy the balance of summer and look forward to speaking with you soon.